Upstart Referral Network

Expand consumer lending confidently

Personal loans are referred to your institution from consumers who apply at Upstart.com and meet your credit criteria.

Personal loans are referred to your institution from consumers who apply at Upstart.com and meet your credit criteria.

The Upstart Referral Network is powered by Upstart’s AI-powered marketplace, enabling fast, all-digital lending with individual risk-based pricing. Qualified applicants on Upstart.com who meet your credit criteria are presented with your institution’s loan offers that can be originated digitally in minutes using your loan documents. Whether you’re looking for super prime borrowers or seeking higher yields with near-prime borrowers, or if you need help meeting your CDFI or LID requirements, we have the right solution to meet your lending goals. You can even target your existing members.

T-Prime enables your institution to grow a high-performing, low-risk loan portfolio of super prime borrowers to whom you can further nurture and cross-sell.

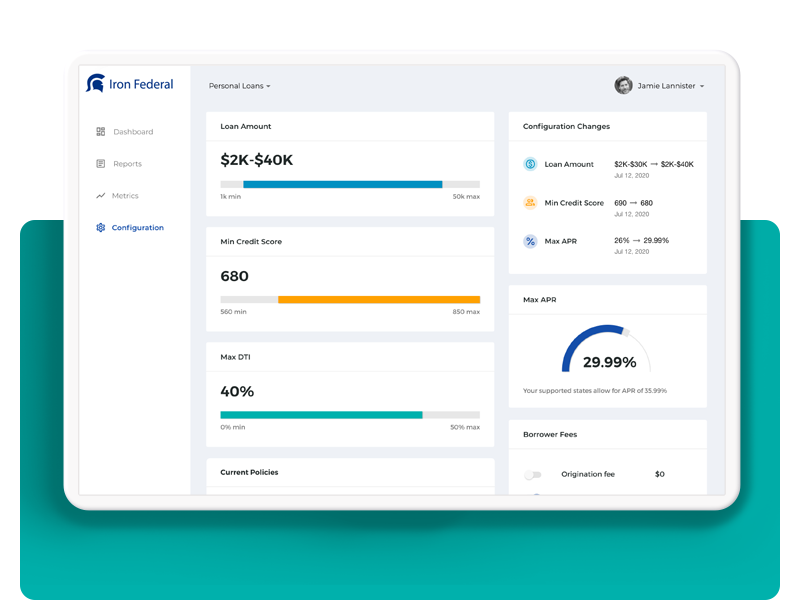

Set more than 15 criteria including minimum credit score, maximum debt-to-income ratio, loan sizes, geography and more.

Upstart’s robust marketing engine uses advanced online and offline strategies to drive demand to Upstart.com, presenting your loan offer to your existing customers and new borrowers who fit your risk profile.

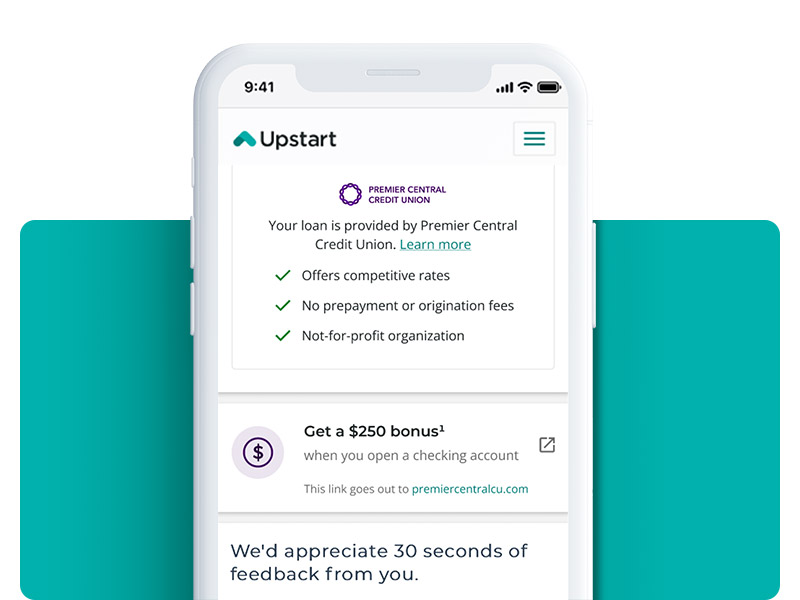

Your loan offer is jointly branded with Upstart.

Mobile-friendly application allows users to finish their application in one sitting.

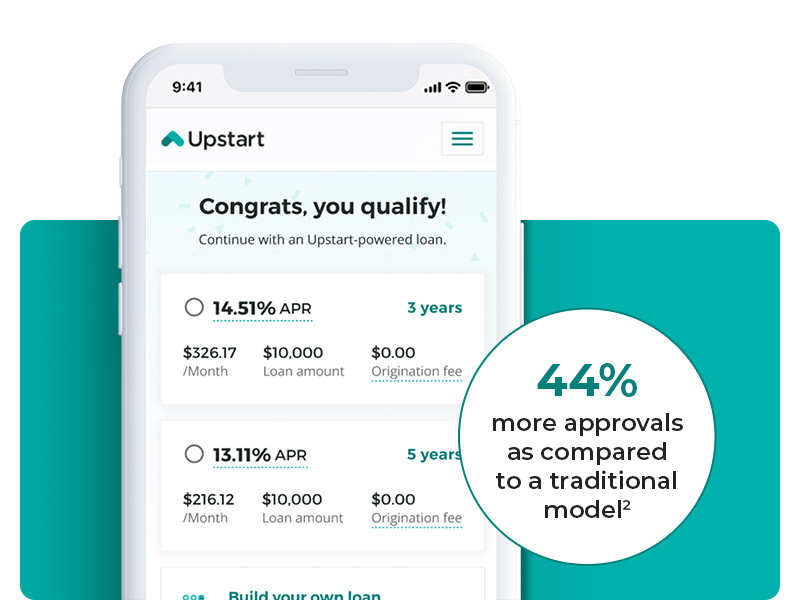

Upstart’s risk-based AI model individually prices and matches applicants within your credit criteria resulting in higher approvals and lower losses.

92% of loans fully automated.²

Upstart’s expert staff manage all exception processes for higher-risk applications.

Same day all-digital signature process.

Next-business day loan funding.

Promote your other products at no cost by presenting digital offers to your new customer after the loan is secured.

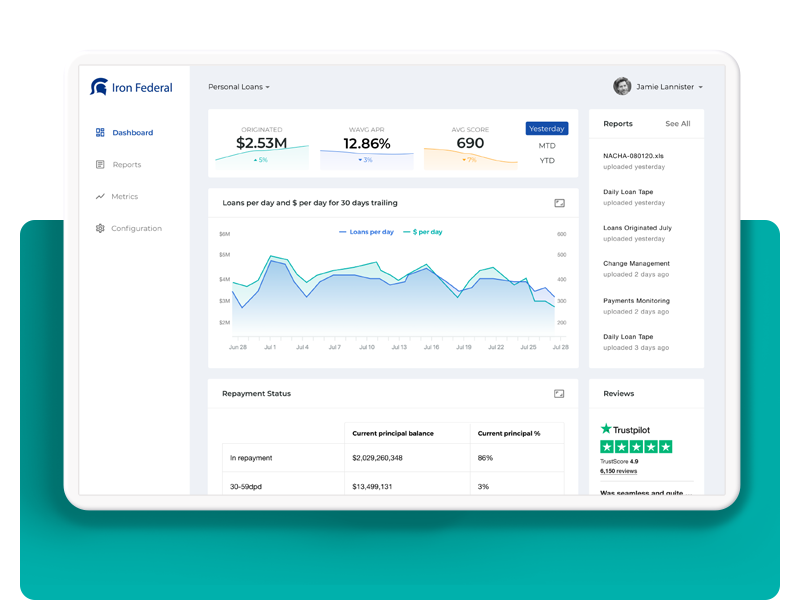

Access insightful metrics and make informed portfolio decisions with the Upstart Performance Console.

Adjust your loan volume and lending parameters as your goals or strategy change.

Upstart’s team of former credit union and bank executives can help manage your program.

1 Program lending parameters are highly configurable and set within the lender’s risk tolerance. Gross Average Return (GAR) is calculated as calculated as APR less expected annualized loss rate. Represents the average GAR received by Upstart lending partners for originations in Q1 2025 using the Upstart Referral Network.

2 In Q1 2025. Percentage of Loans Fully Automated, which is defined as the total number of loans in a given period originated end-to-end (from initial rate request to final funding for personal loans and small dollar loans, and from initial rate request to signing of the loan agreement for auto loans) with no human involvement required by the Company divided by the Transaction Volume, Number of Loans in the same period.