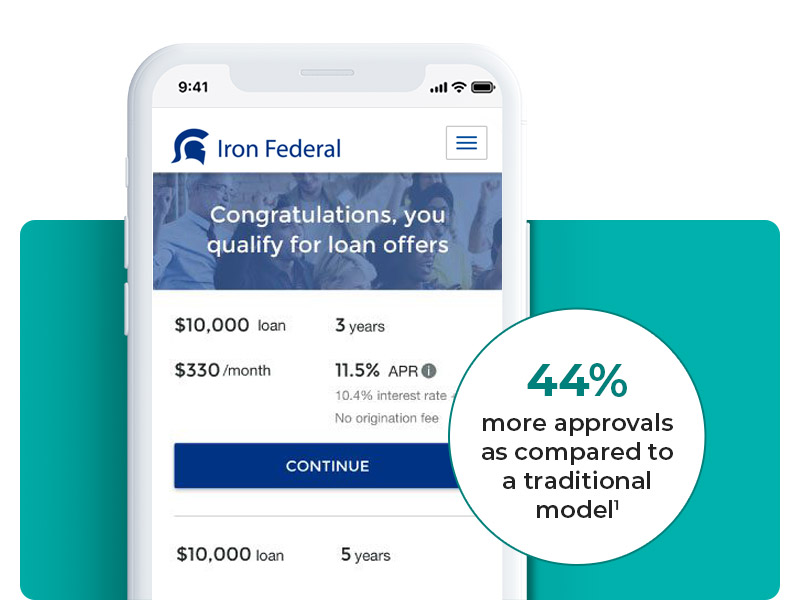

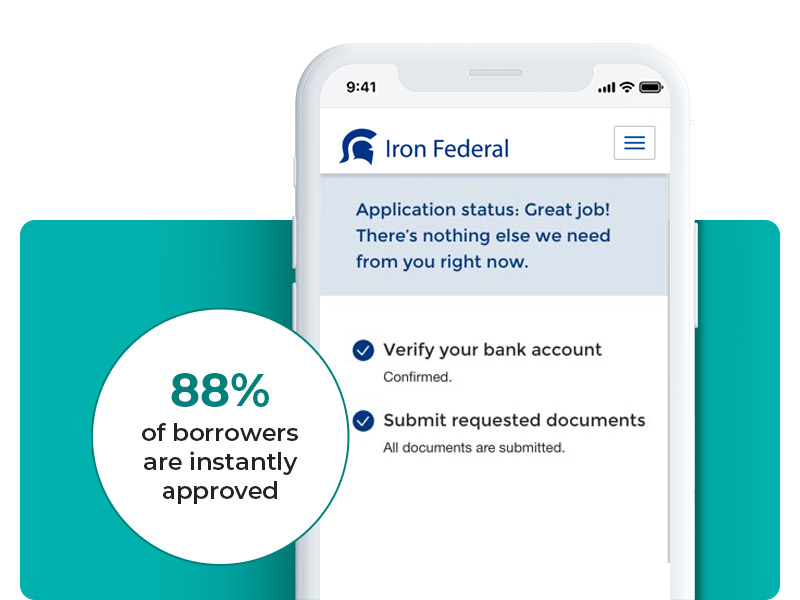

With Upstart, we will be able to serve more credit-worthy members and provide access to capital to those who need it most.

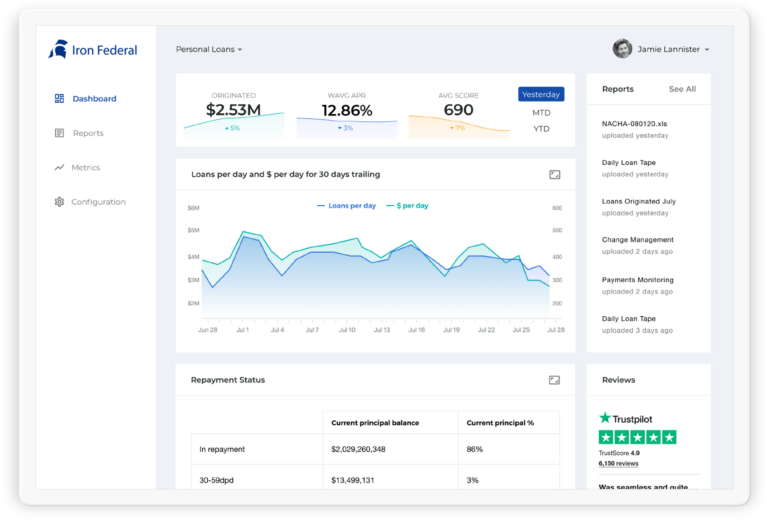

Personal loans

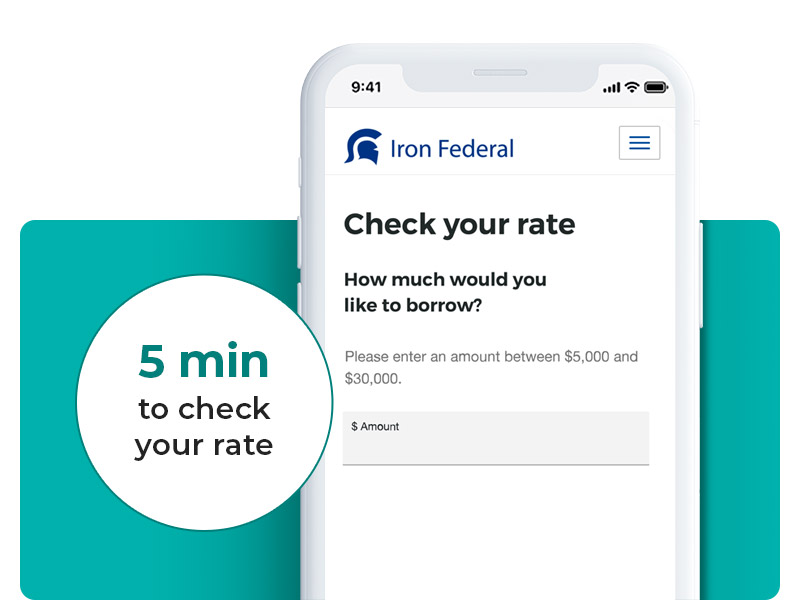

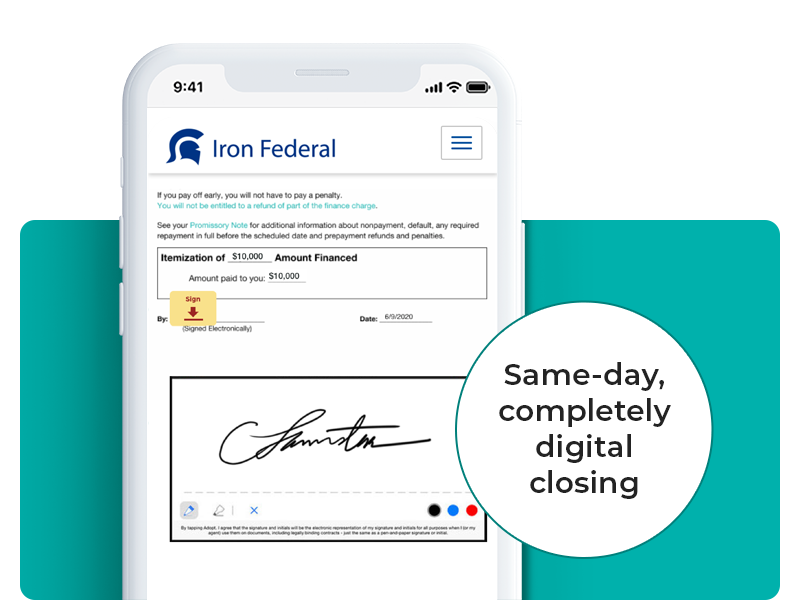

Offer smarter, all-digital personal lending

Deploy Upstart’s Lender-Branded Platform on your institution’s website to offer a turnkey, all-digital lending experience, enabled by AI.