Auto Refinancing

Average monthly savings of $126

Get a personalized rate in minutes

Enjoy an easy 100% online process

Checking your rate won’t affect your credit score.¹

Won't affect

your credit score¹The simple way to refinance your auto loan

We make it easy to save. Check your rate, confirm your details and we'll take care of the rest when it comes to your new auto loan.

Flexible loan amounts

Upstart-powered car refinance loans start at $3,000² and loan terms range from 24 to 84 months.³

Custom rates

Our model looks beyond your credit score and use education and employment to get you the rate you deserve.⁴

No hidden fees

No application fee or prepayment penalty

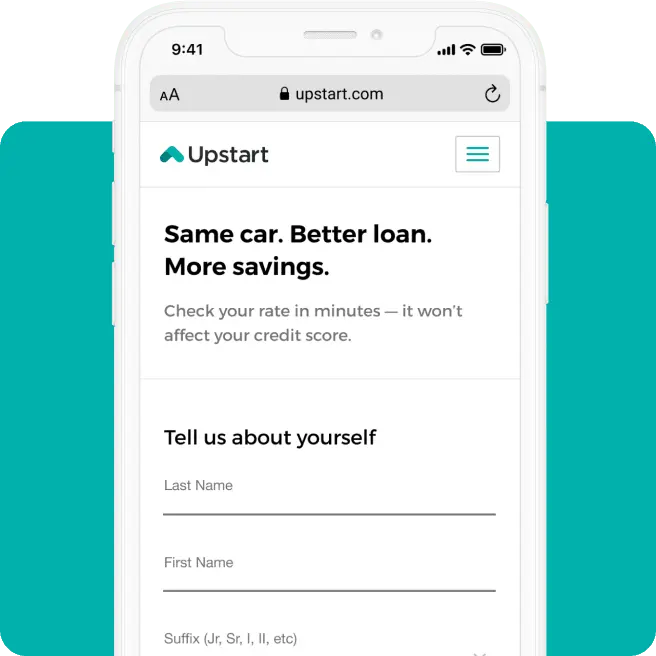

Our online platform makes it easy to check your rate and apply

Check your personalized auto loan refinancing rate in minutes. You could save with a lower interest rate or better terms.

Won't affect

your credit score¹We've helped more than 4 million customers⁵

Jennifer saved over $129 a month⁶

"Not only did my interest rate go down, but my car payment also went down—I wasn't expecting to go down that much!"

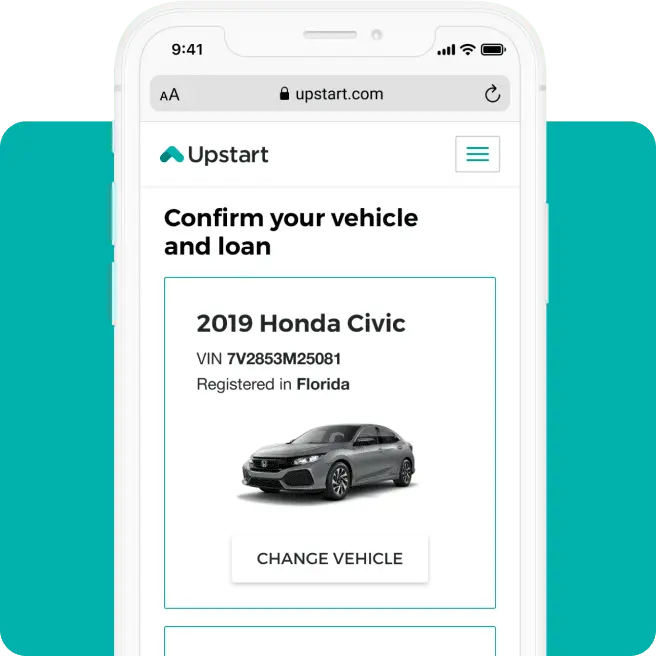

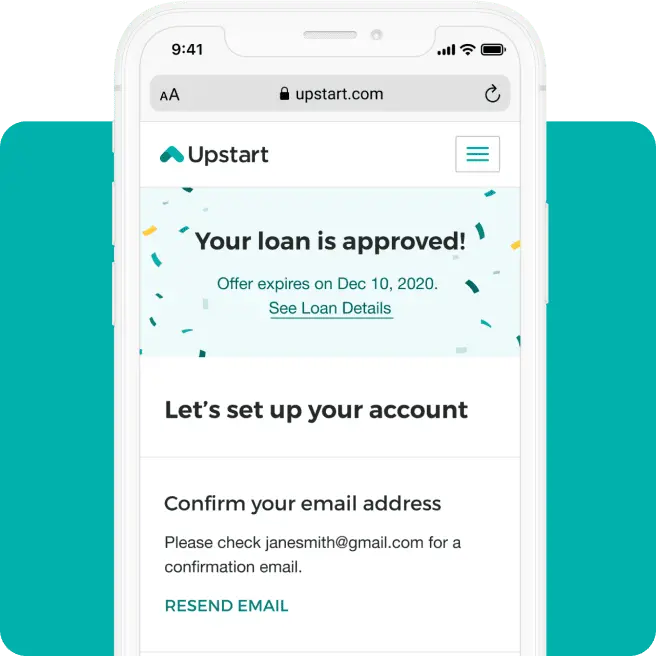

Refinance your car loan online in 3 easy steps

Check your rate

Check your rate in minutes – without affecting your credit score.¹

Confirm your details

Enter your personal, vehicle, and current car loan information.

Get a new loan

We'll pay off your previous auto loan and update your title.

Won't affect

your credit score¹Auto refinance FAQs

What is a car refinance loan?

A car refinance loan is a new car loan that replaces your current car loan under a different term and rate. Car loan refinancing can help you save money by lowering your annual percentage rate (APR) or reducing your monthly payments.Why refinance your car loan?

An auto refinance loan may be right for you if you're looking for a different rate or term on your personal vehicle.Is my vehicle eligible to refinance?

Your vehicle is eligible if it is less than 13 years old and has less than 140,000 miles.What documents will I need for auto refinancing?

When you refinance your car loan, you may be asked to provide documents that verify your identity, education, and income. We may also ask for:

- A copy of your vehicle registration card

- Proof of insurance

- A co-owner consent form (if applicable)

- Proof of open claim or second lien resolution

All document requests will appear in your Upstart dashboard.Will refinancing my car loan affect my credit score?

When you check your rate, we make a soft credit inquiry that won't affect your credit score.

If you go ahead with your application after checking your rate and decide to accept a loan, you will be subject to a hard credit inquiry to verify the accuracy of your application. The hard inquiry may impact your credit score.Does Upstart allow co-owners on a loan?

If you co-own your car, you can refinance your loan as long as the co-owner signs a consent form and provides identification details prior to loan origination.

Your co-owner is not a co-borrower and is not responsible for repayment of your loan. We will only consider the information provided by you, the applicant, in our credit decision. Co-owner information is not considered in the credit decision.Does Upstart allow co-borrowers on a loan?

Our platform doesn't currently allow co-borrowers on refinanced car loans. However, if you have a co-borrower on your current car loan, you may apply to refinance the loan in your name only to remove the co-borrower from the loan.Can I refinance my car loan with a low credit score?

At Upstart, you're more than your credit score. Your auto loan rate should reflect that, too. That's where our "smarter rates" come in. Auto refinancing offers from Upstart-powered lenders consider important details beyond your credit score, like your education and employment.⁴ We think that's pretty smart. See if you qualify—checking your rate doesn't impact your credit score.

See what you could save

Won't affect

your credit score¹More personalized loan options

1. When you check your rate, we check your credit report. This initial (soft) inquiry will not affect your credit score. If you accept your rate and proceed with your application, we do another (hard) credit inquiry that will impact your credit score. If you take out a loan, repayment information may be reported to the credit bureaus.

2. Your loan amount will be determined based on your credit, income, the outstanding balance of your current auto loan, and certain other information provided in your loan application. Not all applicants will qualify for the full amount.

3. The full range of available rates varies by state. The lowest rates are only available to the most qualified applicants. A representative example of payment terms for an Auto Refinance Loan is as follows: a borrower receives a loan of $20,000 for a term of 60 months, with an interest rate of 11.7% and an origination fee of $1000, for an APR of 13.44%. In this example, the borrower will receive $19,000 and will make 60 monthly payments of $443. APR is calculated based on 5-year rates offered in December 2025. There is no downpayment and no prepayment penalty. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved.

4. Although educational information is collected as part of Upstart's rate check process, neither Upstart nor its bank partners have a minimum educational attainment requirement in order to be eligible for a loan.

5. As of 12/31/2025, across the entire Upstart marketplace.

6. This information is estimated based on all consumers who were approved for an auto loan through the Upstart platform and accepted their final terms. In December 2025, the average monthly payment savings amount was $126. To evaluate savings on a loan you are considering refinancing, it is important to compare your APR and remaining term from your existing auto loan to the APR and term offered through Upstart.

Car refinance loans not available in IA, MD, NV, WV.

Upstart is not the lender. All loans on Upstart's marketplace are made by regulated financial institutions.