Consolidate your credit card debt with ease

Check your rate in 5 minutes.

Get funds sent in as fast as 1 business day.²

Combine multiple bills into 1 fixed monthly payment.

Won't affect

your credit score¹Why choose Upstart for credit card debt consolidation?

Our model looks at factors beyond your credit score, like education³ and employment, to find you a rate you deserve.

Flexible loan amounts

Choose an amount for a credit card consolidation loan between $1,000 and $75,000.⁴

Fixed rates and terms

Choose between 3 or 5 year terms, with fixed rates of 6.2% - 35.99% APR.⁵

No prepayment fees

You can prepay your loan at any time with no fee or penalty.

We've helped more than 4 million customers⁶

Julia paid down credit card debt through Upstart⁷

"I was able to wipe out credit card debt and consolidate all payments into one. This one payment was less than all three minimum payments for each credit card."

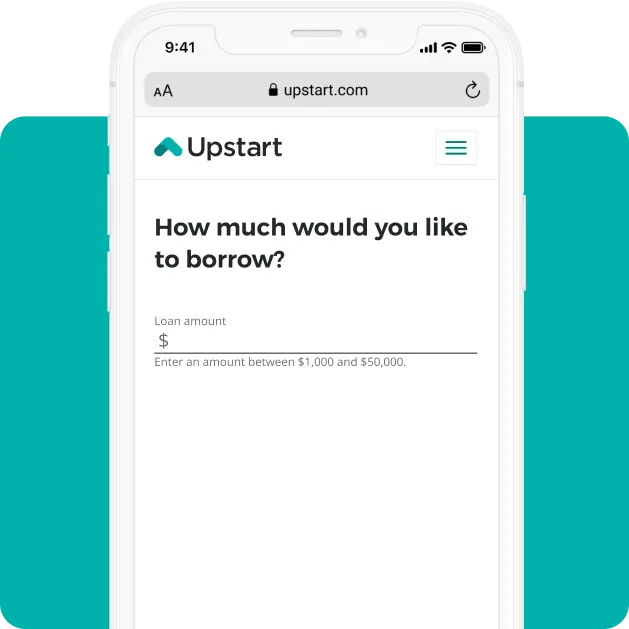

Consolidate credit card debt online in 3 easy steps

Get your rate

It takes less than 5 minutes to check your rate—and it won’t affect your credit score.¹

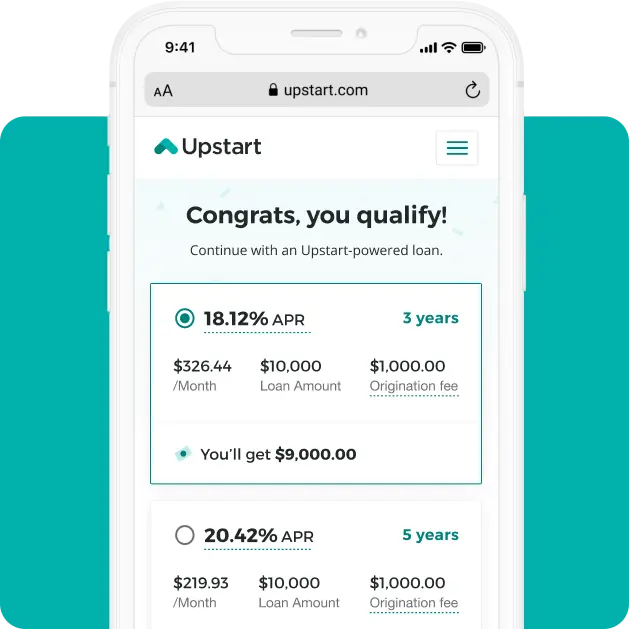

Get approved

Find out if you're approved, instantly with no paperwork required.⁸

Get funds

Once approved, you could get funds sent in 24 hours or less.²

Won't affect

your credit score¹Credit card consolidation loan FAQs

What is a credit card consolidation loan?

A credit card debt consolidation loan is a type of personal loan used to pay off credit card debt. When you take out a loan to consolidate your credit cards, you use the funds to replace your high-interest credit card debt. You may also be able to save more each month with a lower interest rate. Then, you start making payments on your credit card consolidation loan until you reach your payoff date.Is consolidating my credit cards a good idea?

Using a loan to consolidate credit card debt may be a good idea if the interest rate on the loan is lower than your current credit card rates.

A lower rate can help you save money each month in interest. In addition, a personal loan to pay off credit card debt often comes with fixed rates, predictable monthly payments, and a known payoff date. As a result, you may be able to lower your monthly payments or pay off your debt faster.Does consolidating my credit cards hurt my score?

When you check your rates, we will perform a soft credit inquiry that won’t affect your score.

If you decide to submit an application and go ahead with your credit card loan, we’ll run a hard credit inquiry to verify your information. The hard credit inquiry will impact your score, but timely monthly payments can help improve it.Should I consolidate my credit cards into one payment?

Consolidating credit card debt into 1 payment makes it easier to keep track of your bills and avoid missed payments. Depending on your loan terms and APR, you could even save money in interest or pay off your credit card debt faster.How do I apply for credit card consolidation loans?

You can apply for a loan to pay off credit cards online. Get started by checking your rate using our simple funding form to submit details such as your income and education.³ If you’re eligible for a credit card consolidation loan through us, you could see several offers with different rates, terms, and payments in 5 minutes or less.Are there other options for consolidating credit cards?

Yes. You can pay off your balances in cash if you have the funds. You may also be able to qualify for a 0% introductory APR balance transfer card to consolidate your credit cards. Balance transfer cards may allow you to pay off your debt with no interest fees for a short period, but some come with high transfer fees.Credit card refinancing vs. debt consolidation

Credit card refinancing and debt consolidation are similar. Credit card refinancing tends to focus more on potentially saving money on revolving credit card debt versus combining multiple debts into 1 payment. Both could involve using a credit card payoff loan with more favorable terms–such as lower interest rates–to replace your current credit card balances.How long does it take to get a credit card consolidation loan?

If you get approved and accept your loan terms, you could get your credit card consolidation funds in as little as 1 business day.² You can then use the money to pay off your credit card balances immediately.Can I get a credit card consolidation loan with bad credit?

We believe you’re more than your credit score.

Our lending partners consider factors like education³ and employment when setting your rates. In many cases, it means you may be able to qualify for a credit card loan while building–or rebuilding–your credit score.

The smarter way to consolidate credit cards

Won't affect

your credit score¹Other loan options

1. When you check your rate, we check your credit report. This initial (soft) inquiry will not affect your credit score. If you accept your rate and proceed with your application, we do another (hard) credit inquiry that will impact your credit score. If you take out a loan, repayment information may be reported to the credit bureaus.

2. If you accept your loan by 5pm EST (not including weekends or holidays), your funds will be sent on the next business day. When the funds will be available to you will depend on your bank’s transaction processing time and policies.

3. Neither Upstart nor its bank partners have a minimum educational attainment requirement in order to be eligible for a loan.

4. Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will qualify for the full amount. Minimum loan amounts vary by state: GA ($3,100), HI ($1,500), MA ($7,000). Maximum loan amounts may vary by state.

5. The full range of available rates varies by state. The lowest rates are only available to the most qualified applicants. A representative example of payment terms for an unsecured Personal Loan is as follows: a borrower receives a loan of $10,000 for a term of 60 months, with an interest rate of 18.60% and a 7.82% origination fee of $782, for an APR of 22.69%. In this example, the borrower will receive $9,218 and will make 60 monthly payments of $259. APR is calculated based on 5-year rates offered in December 2025. There is no downpayment and no prepayment penalty. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved.

6. As of 12/31/2025, across the entire Upstart marketplace.

7. Images are not actual customers, but their stories are real.

8. The majority of unsecured loan applicants on the Upstart marketplace are able to receive an instant decision upon submitting a completed application, without providing additional supporting documents, however final approval is conditioned upon passing the hard credit inquiry. Loan processing may be subject to longer wait times if additional documentation is required for review.

Upstart is not the lender. All loans on Upstart's marketplace are made by regulated financial institutions.