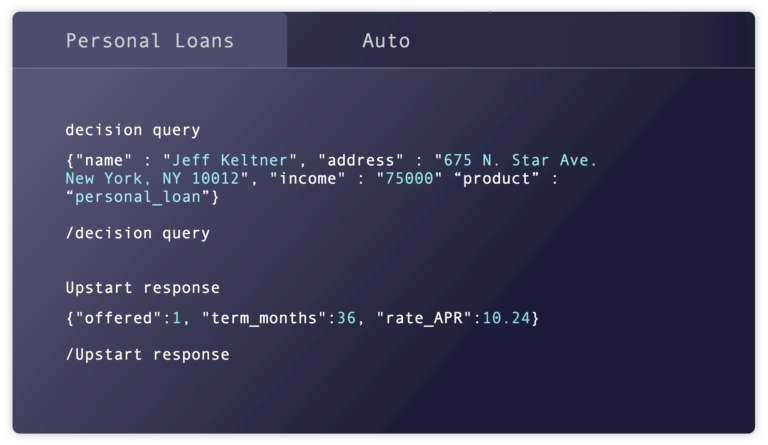

Upstart’s Credit Decision API will enable us to increase the speed of lending decisions, better price applicants and more accurately assess risk, ultimately to better serve our customers.

Credit Decision API

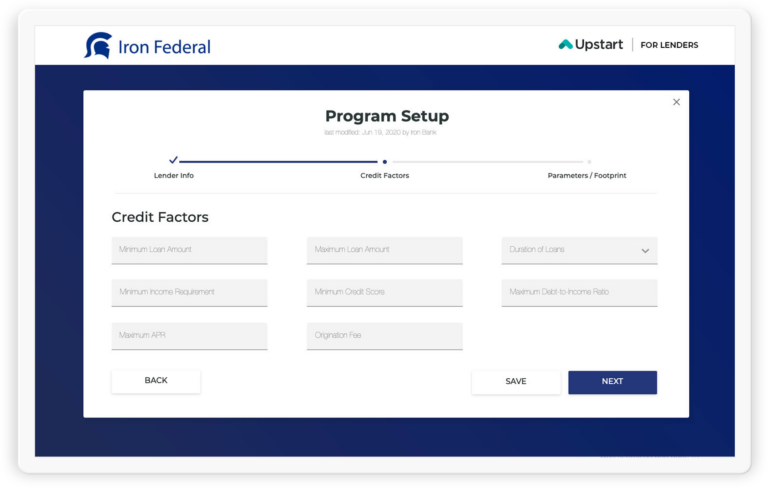

Integrate Upstart’s AI underwriting technology into your existing origination process to deliver instant decisioning with accurate, risk-based pricing.