Have you heard about ChatGPT? It’s an exciting new technology that uses artificial intelligence (AI) to understand and create text as if it were done by a human. With its natural language processing capabilities, it has quickly become a sensation and has already been used by over a million people in just one week. From helping with language translation to reviewing code, ChatGPT can assist with various tasks. Let’s dive in and discover what this AI-model can do.

How does ChatGPT work?

ChatGPT is a large language model that uses a type of AI called “deep learning” to understand and generate human language. It’s trained on a massive amount of text data, allowing it to understand and respond to various topics and questions.

The model is based on a type of neural network called a transformer, which can process input data more efficiently and effectively than previous models. When you ask ChatGPT a question or give it a prompt, it uses the information it learned during training to generate a response. This response is generated on-the-fly based on the input it receives. ChatGPT can be used for various tasks, such as answering questions, rendering text, and even writing fiction.

Personal finance knowledge with ChatGPT

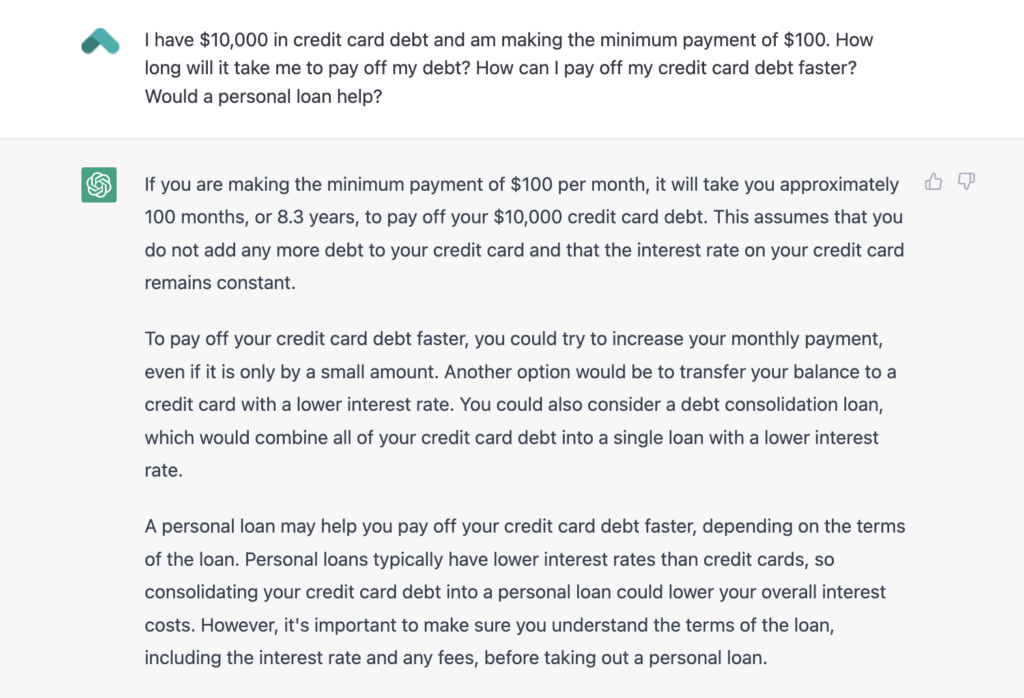

There are a lot of applications with ChatGPT, but can it help your personal finance on a day-to-day basis? The answer is…yes! It has the capability of giving you financial education, especially if you’re new to personal finance. ChatGPT can provide you with easy-to-digest information on important concepts, such as budgeting, saving, investing, and retirement planning. While ChatGPT doesn’t replace financial advice, it can help you make sense of terms and reach your financial goals faster.

Here are six ways you can use ChatGPT for your personal finance:

1. Understanding key financial concepts with ChatGPT

We all hear about the term “financial literacy” and how to improve it—but what does that mean? ChatGPT is a helpful tool for expanding your financial acumen. You can use ChatGPT to input specific questions or prompts related to terms you want to better understand. For example, you could ask ChatGPT, “What is the difference between secured and unsecured debt?” or “What is revolving debt?”

Pro Tip: If the answer is still too complicated or doesn’t make sense, just let ChatGPT know! It builds upon your previous conversation and reacts to feedback. You can respond by asking ChatGPT to simplify its answer, or ask how it would explain the same concept to a fifth grader.

2. Budgeting and expense tracking with ChatGPT

Creating a budget is a great way to take control of your finances and make sure your money is going where you want it to. Budgeting involves setting a plan for how you’ll spend your money each month, based on your income and expenses. With ChatGPT’s help, you can make a budget that’s tailored to your specific needs.

To get started, let ChatGPT know how much money you earn each month and how much you spend on different things, like rent, groceries, and entertainment. Once you’ve input this information, you can set some financial goals for yourself, like saving up for a vacation or paying off a credit card by a certain date. Then, check your budget regularly and make adjustments as needed.

Pro tip: Consider using the 50/30/20 rule. This rule suggests that you should spend 50% of your income on necessities like housing and food, 30% on wants like shopping and eating out, and 20% on savings and paying off debt. ChatGPT can help you figure out how much money you should be spending in each category and might even make suggestions on how to adjust your spending habits. Keep in mind every situation is different and this is a rule of thumb that may not work for everyone. If you want more specific guidance, we encourage you to discuss with a financial planner.

And remember, the more honest you are with ChatGPT about your income and expenses, the more accurate its suggestions and guidance could be for your financial situation. With ChatGPT, you can create a budget that works for you and achieve your financial goals.

3. Credit score and credit report monitoring with ChatGPT

Your credit score is a key factor in your overall financial health, and ChatGPT can help you stay on top of it. You can get information on how to monitor your credit score and credit report through ChatGPT—and also get tips and ways to better your score, such as paying your bills on time and keeping your credit card balances low.

Pro tip: Use ChatGPT to help you understand the process of disputing any errors or inaccuracies you find on your credit report. By having the right information, you’ll be more informed and better equipped to improve your score.

4. Reaching your savings goals with ChatGPT

Saving money is an essential part of managing your finances, and ChatGPT can also help you set and reach your savings goals. The first step is to decide what you want to save for, whether it’s a specific purchase, like a down payment on a house, or a long-term goal, such as retirement at a certain age. Once you’ve established your goal, you can get creative on getting quick information from ChatGPT. Here are a few more ways it can help with reaching your saving goals faster:

- Explain the concept of compound interest and how to apply it to your current savings plan.

- Guide on how to use the envelope method, where you assign a specific amount of cash to different categories of expenses, to control your spending.

- Guide on how to do the “no-spend” challenge, where you don’t spend any money on non-essential items for a certain period.

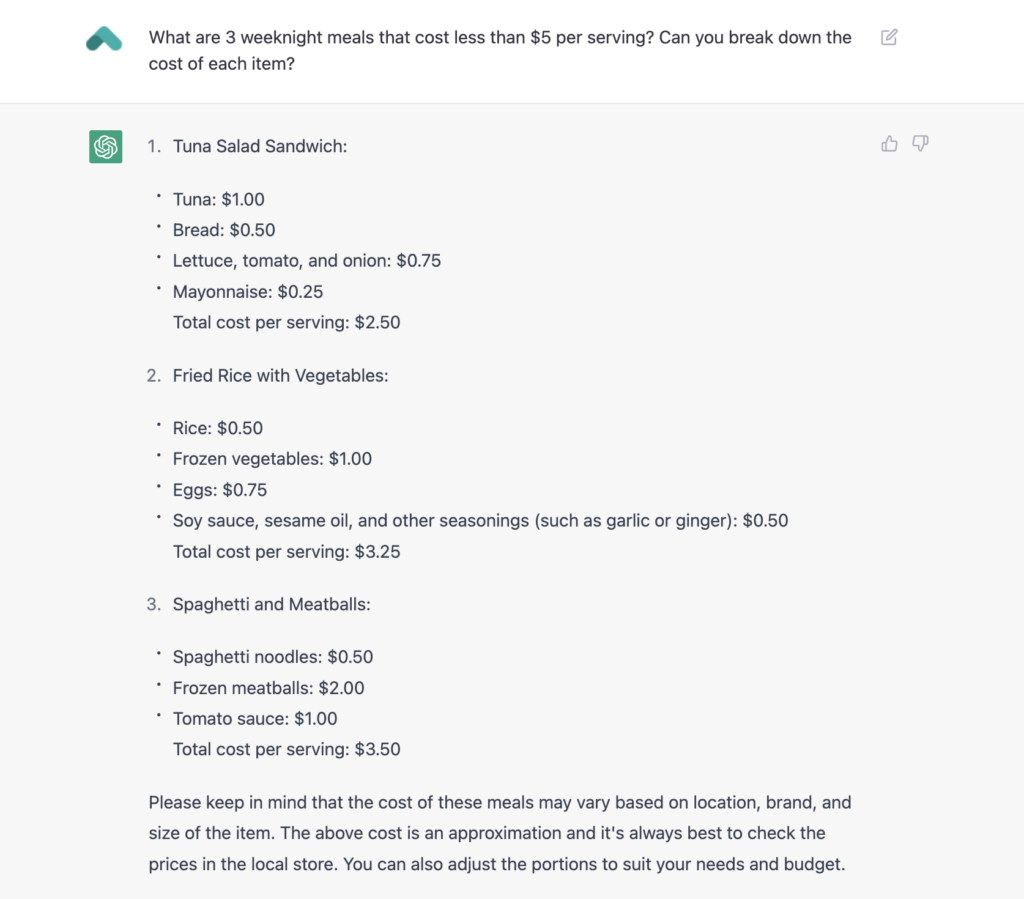

And if you want more creative and fun ways to save, you can use ChatGPT to help come up with ideas—the possibilities are endless. For example, ChatGPT can help you brainstorm 3 weeknight meals that cost less than $5 per serving and break down the general cost of each item, or 10 free date night ideas in your city.

5. Retirement planning with ChatGPT

Retirement planning is an important aspect of personal finance that many people overlook. ChatGPT can assist you with retirement planning by providing guidance based on your current savings and projected income. This can help you estimate how much money you will need to save to achieve your retirement goals. Additionally, ChatGPT can provide you with information on different retirement savings options, such as 401(k)s and IRAs. Use ChatGPT to understand the pros and cons of each option and help you decide which one is best for you.

6. Understanding and preparing for tax season with ChatGPT

Tax preparation can be daunting, but ChatGPT can help make it easier. Remember that ChatGPT is not a replacement accountant but can arm you with the knowledge to make smarter decisions. Here’s how you get started in preparing for tax season and make the process easier with ChatGPT:

- Ask ChatGPT for guidance on maximizing deductions and minimizing tax liability based on your specific financial situation.

- Request information from ChatGPT on different tax laws and regulations that apply to your situation, such as deductions, credits, and exemptions.

- Leverage ChatGPT for tax-saving strategies that may apply to your situation, such as taking advantage of deductions and credits that you may be eligible for.

- Utilize ChatGPT’s guidance on record keeping to ensure that you have all the necessary documents and information for when you begin filing your taxes.

Using AI to achieve your financial goals

ChatGPT is just one example of AI improving your access to information.

Upstart’s mission is to improve access to affordable credit and empower more people to achieve financial success. Our AI-model considers a wider range of factors than traditional lending institutions when making loan decisions (we look at more than your credit score). This helps increase financial inclusion and provides a more personalized lending option.

When it comes to leveraging AI, it can be an invaluable tool for managing your personal finances, such as providing tailored guidance on budgeting, saving, and reaching a financial goal. While ChatGPT is a powerful tool that can help you with many applications, it’s important to keep in mind that it’s not perfect. There are limitations to be aware of, such as ChatGPT not using common sense and having difficulties understanding abstract concepts or complex reasoning. It’s always good to verify the information provided to you, especially when it comes to your personal finance.

Disclaimer: Upstart is not affiliated with ChatGPT or Open AI. Currently, ChatGPT has knowledge up to 2021. Any tax laws or regulations implemented after 2021 may not be reflected. ChatGPT should NOT be used as a replacement for financial advice. Always be careful when inputting personal information into online systems.

Won't affect your credit score¹

Won't affect your credit score¹