Key takeaways:

- When you refinance a car loan, you replace your original loan with a new one.

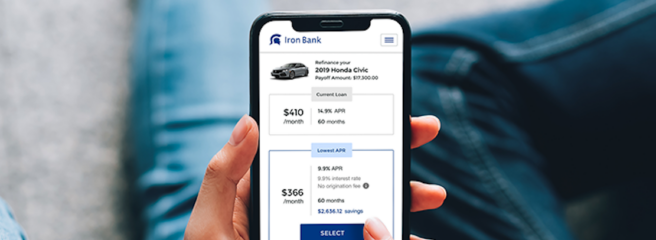

- Refinancing your auto loan can help you save money each month with reduced loan payments or a lower interest rate.

- Generally, borrowers with a higher credit score have the best chances of securing a lower interest rate on an auto refi loan. However, you may be able to qualify for a better rate by applying for a loan through an alternative lending platform, like Upstart.

If you’re like most car owners, you’d probably want to save money on your monthly payments. But once you’re locked into an auto loan, it may seem impossible to adjust your payments.

Auto loan refinancing may be the solution you’re looking for. Auto loan refinancing may help you save money by reducing your interest rate or lowering your monthly installments. In this guide, we’ll look at what auto refinancing is, how it works, and how to decide if it’s right for you.

What does refinancing a car mean?

When you refinance your auto loan, you replace your existing loan with a new one. Essentially, you use the money from the new auto loan to repay your old loan’s balance. Then, you begin paying off the balance on your new auto loan, plus interest. Ideally, your new auto loan should have better terms than your original loan.

When should I consider refinancing?

Refinancing can be a great choice if you have solid credit and are able to take advantage of the benefits that come with it.

Generally, you’re in the best position to consider refinancing if:

- Your credit score has increased.

- Auto loan refinance rates have dropped.

- Your monthly payment is too high.

The benefits of refinancing

Under the right circumstances, refinancing can have numerous benefits. Some of these may include:

- Your monthly payments may be lower.

- You can get lower, more affordable interest rates.

- You’ll have the potential to repay debt faster with a shorter repayment period.

- You can get cash from equity.

Read on for a closer look at the pros and cons of refinancing a car loan.

Is refinancing a car worth it? Pros and cons of refinancing a car loan

Ultimately, making the decision to refinance depends on your financial goals and current circumstances. It’s important to weigh the pros and cons of refinancing an auto loan before doing so. Consider the following to determine if refinancing is a good financial move for you.

Pros of refinancing a car loan

- You may be able to reduce your loan payments. Refinancing a car loan could help you lower your monthly car payments in a few ways:

- You could save on monthly installments if you get a loan with a lower interest rate.

- You may be able to reduce your monthly payment by extending your loan term.

A longer repayment term often results in lower monthly payments. This can be beneficial if you’re struggling to make your payments. However, you may spend more in interest over the life of the new loan.

- You may be able to qualify for a lower interest rate. In some cases, you may be able to secure a better interest rate by refinancing your loan. This is especially true if your credit score has improved or market rates have dropped since you took out your original car loan.

Pro tip: Not sure how your credit score stacks up? Consider checking your rate for an auto refinancing loan through Upstart. Our model looks beyond your credit score and includes factors like your education¹ and work experience to find you a loan.

- You may be able to repay your loan sooner. Refinancing may allow you to pay off your car faster by replacing your existing loan with shorter-term financing. For example, if you initially agreed to a 7-year loan, you may be able to replace it with a 3- or 5-year term. Your monthly payments might be higher, but you could potentially save on interest and reach your payoff date sooner.

Cons of refinancing a car loan

- You may pay more in interest after refinancing. In some cases, refinancing may allow you to save on monthly payments, but it could end up costing you more in the long run. This is especially true if you extend the term of your loan when you refinance.

For example, if your initial car loan had a 3-year term and you refinance for a 5-year loan, you’ll have to pay interest for an additional 2 years. Depending on the rate and loan amount you qualify for, you could spend hundreds or thousands of dollars over the term of the loan.

- You could face prepayment or refinancing fees. Some loans come with prepayment penalties or refinancing fees. If you’re still in the early stages of your loan, the long-term savings of a more affordable loan could outweigh any fees and penalties. However, it’s important to calculate how much you may owe before making the decision to refinance.

- Your credit score could take a hit. Finally, refinancing your auto loan could cause your credit score to drop a few points. That’s because a loan provider will run a hard credit inquiry before approving your loan. A hard inquiry will also appear on your credit report, which can reduce your credit score.

Pro tip: You can typically restore your score by making timely payments on your loan and practicing good credit habits, like reducing your credit utilization rate.

Ready to refinance your auto loan? Upstart may be able to help

Making the decision to refinance an auto loan requires a lot of thought. However, it may be an impactful way to cut costs each month, save on interest, or pay off your auto loan faster.

As with any financial decision, take the time to research your options and determine if refinancing your car loan is right for you. Most importantly, shop around for the best rate so you can save more each month while setting yourself up for financial success.

If you’re ready to refinance your auto loan, learn more about the process in this step by step guide to auto refinancing.

¹Neither Upstart nor its bank partners have a minimum educational attainment requirement in order to be eligible for a loan.

Car refinance loans not available in IA, MD, NV, or WV.

Won't affect your credit score¹

Won't affect your credit score¹