Key takeaways:

- Annual percentage rate (APR) represents the total cost of borrowing money or carrying a revolving credit card balance.

- APR includes charges and fees like interest, origination fees, processing fees, and more.

- APR and interest can vary significantly, making it critical to review both rates before taking out a loan.

You see words like APR (annual percentage rate) and interest rate when it comes to loans and credit cards, but what are the differences? Annual percentage rates and interest rates are two different ways of measuring the cost of borrowing money.

Annual percentage rates include fees, such as the closing costs on a mortgage or an origination fee on a personal loan. The calculation is based on the amount financed, the finance charge, and how payments are scheduled. You can use either number to shop around for loans and credit to find the best option, but the APR is a better comparison tool because it also includes other fees, not just interest.

As an example, let’s say you want to borrow $20,000 with a four-year term and are offered two loans. One has a 7.9% interest rate and no origination fee. The other has a 5.9% interest rate and a $1,000 origination fee. Looking at each loan’s APR can help you figure out which is the better deal.

Understanding how it works will give you a better handle on managing your debt and help you make more strategic decisions when choosing financial products.

What is an interest rate?

An interest rate is a cost you will pay each year to borrow money and does not reflect fees or any other charges you may have to pay back the money—expressed as a percentage.

For example, according to the Federal Reserve, the average interest rate on a personal loan as of August 2021 is about 10%, which means that each month on an annual basis, you’ll pay 1/12 of this on your remaining balance. If your remaining balance is $10,000, you’d multiply 10% by $10,000 and divide by 12 to get $83.33. This is an example of how much your monthly payment would go to your lender as payment for borrowing money.

Over time, as your balance gets smaller, your interest payment also gets smaller, and more of your payment will go towards paying down the loan. This is the basis for how loan amortization—or paying down your debt— works.

What is an APR?

An APR, or annual percentage rate, is a rate that measures the cost (sometimes referred to as the finance charge) to borrow money.

It’s good to know your interest rate because that’s a direct measure of how much your lender charges you each month for borrowing money. But that’s also not the only charge. Depending on the lender, there might be other fees which can include:

- Annual fees

- Loan origination fees

- “Discount points,” or fees you pay to lower your interest rate on a mortgage

It doesn’t include all the fees you might pay throughout the loan, such as late fees or prepayment penalties. It only consists of the fees you must pay to borrow money.

It’s also worth mentioning that if there are no origination fees or other costs of borrowing money, the interest rate and APR can be the same. This is often the case with credit cards.

Since the annual percentage rate measures the total cost of borrowing money, it’s usually better to use than the interest rate when comparing loans.

What types of APRs are there?

We’ve learned that APRs are a better comparison tool for loan shopping. Not all APRs are created equal—there are some differences you’ll need to be aware of to make an informed decision.

Fixed interest rate vs. variable interest rate

Most types of loans and credit cards are divided into two categories: fixed interest rates and variable interest rates. Debt with fixed interest rates doesn’t change over the life of the loan, even if rates change. Debt with variable rates, on the other hand, will change.

It’s also important to note that since APRs include the interest rate in their calculation, you’ll also see these two options. A fixed rate loan will also be a fixed APR loan, and vice versa.

APR on credit cards

Credit cards are a special case because they can have multiple APRs depending on how you use the card. You can find the details in your cardmember agreement, but here’s what to keep an eye out for:

- Purchase APR: This is the APR that applies to things you buy. Most people only use their credit card to buy things, and so this is the most common source of credit card interest.

- Cash advance APR: If you use your credit card to get cash, such as from an ATM, you’ll usually be charged a higher rate on that debt

- Balance transfer APR: If you transfer a balance over from another credit card, you might pay a different interest rate on that debt than if you’d originally purchased it with that card

- Promotional APR: Many credit cards offer 0% interest on purchases and/or balance transfers for a set number of months after you open the card, as a way to bring in new customers

- Penalty APR: If you pay late, you could be charged a higher interest rate as a penalty on your balance going forward

- Overdraft protection APR: Some bank-issued credit cards allow you to link it up as a backup in case you overdraft your checking account, but they may charge you a different rate.

Credit cards also tend to have variable APRs, as their interest rates are usually tied to a benchmark rate (like the prime rate).

APR on a personal loan

Similar to a mortgage, a personal loan APR includes interest and fees. You can use Upstart’s loan calculator to find out what kind of annual percentage you can expect to pay, based on the loan amount and repayment terms.

How does APR work?

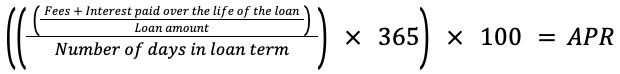

It’s usually much easier to just use a calculator to figure out a loan’s annual percentage. Here is an example of how it is typically calculated:

Some of these numbers will need calculations in their own right. For example, you’ll need to calculate the total interest you pay over the life of the loan first. Once you have that number, you can then work in a hypothetical 6-month and $1,000 loan with a $50 origination fee and a simple interest rate of 6%:

- Calculate fees + interest paid: For this loan, you’d owe $30 in interest over the life of the loan, according to an interest calculator. With the $50 origination fee, that works out to $80.

- Divide the costs by the loan amount: This tells you how much the loan costs relative to the amount you’re borrowing. Here, it’s 0.08 ($80 / $1,000).

- Divide by the number of days in the loan term: This is a 6-month loan, so there are 182 days in the loan term. This works out to 4.40 x 10-4.

- Multiply by 365: This puts things on an annual basis, so you can easily compare across different term lengths. This works out to 0.16.

- Multiply by 100: This puts everything on a percentage basis, so it’s even easier yet to compare. This works out to 16%.

You can really see the difference between APR vs. interest rate with this loan. This hypothetical loan has an interest rate of 6%, but once you factor in the relatively high cost of the $50 origination fee, the APR is actually 16%—which is much higher. That’s why it’s better to compare loans based on APRs and not on interest rates alone.

What does a 24% APR mean?

If you have a credit card with a 24% APR, it is the rate you’re charged over 12 months—this means that each month comes out to be 2% (24% divided by 12 months). This shows how much you have to pay to borrow money monthly.

Sometimes months vary in length, and the breakdown of APR on credit cards goes even further into the daily periodic rate (DPR)—the APR would be divided by 365 (days in a typical year); this would be 0.065% per day for a credit card with a 24% APR. For most credit card charges, you’re only charged APR when you carry a balance from month to month. Try to pay off your balances before the statement due dates and avoid all interest charges.

What are good APRs?

A good APR is better than the average that is being offered. The current average for all new credit card offers as of October 2022 is 22.21%—depending on your financial standing, a good APR would be below 22.21%. As for personal loan, the average as of August 2022 is 10.16% for a 24-month personal loan.

It is important to note that most credit cards and personal loans don’t offer one rate to everyone—lenders typically offer a range of possible rates based on your financial standing, credit score and other information in your credit report. In the current macroeconomic environment, interest rates may continue to go up, so it is important to take note of the offers you are getting and check in on additional fees before opening up a new credit card or loan.

Truth in Lending Disclosure

Different types of products may have very different closing costs causing a much larger discrepancy between the interest rate and the APR. No matter what kind of personal credit product, the APR should be disclosed to you prior to opening the account on a Truth in Lending Disclosure.

The Truth in Lending Disclosure also contains other important information such as:

- Finance Charge: This is the cost of borrowing expressed by a dollar amount

- Amount Financed: This is the amount of credit provided to you. For example, if the cost of borrowing includes a prepaid origination fee, this amount would reflect what you receive after the origination fee is deducted

- Total of Payments: This figure provides you the total amount you will pay if you make payments according to the payment schedule. This amount includes the interest and principal paid back

- Payment Schedule: The payment schedule summarizes monthly payment amounts, when those amounts are due and how many payments will be due.

- Other Fees

If there are other fees, such as a late payment charge, this fee information will be notated.

Bottom line

The interest rate is important because you can use it in calculators and by-hand calculations to figure out details like how much of each monthly payment goes to your lender, and how much total interest you’ll pay over the life of the loan.

Knowing the APR helps you understand the total amount of what you are paying on a credit card or loan. It also serves as a basis for comparing financial products from different lenders and making more informed decisions.

Won't affect your credit score¹

Won't affect your credit score¹