Key takeaways:

- Debt consolidation can be an effective way to increase net worth in a short amount of time.

- Debt consolidation loans can offer lower monthly payments, decreased overall payments, or both, depending on the loan term.

- When considering debt consolidation, it’s important to know your debt, goal, new interest rate and loan terms, choose the best option, and pay off the previous debts.

Of all the possible ways to increase your net worth in a short amount of time, consolidating your debt is one of the most effective ways.

Have you ever been faced with choosing between sticking to your budget and shelling out for a friend’s birthday party? This is a feeling that many people on a budget tend to experience, and it’s not a pleasant one.

Miscellaneous expenses can add up on top of fixed expenses (think mortgage and/or student loan payments), and sometimes swiping a credit card can feel like the easiest way to bridge the gap in the short run. If you don’t ultimately earn enough to pay your bills, you may find yourself with mounting debt.

That’s where debt consolidation comes in. When you consolidate debt, you can switch out multiple loan payments with one loan on new terms. It can take a matter of minutes to fill out an application; just a small investment of time can save you thousands of dollars over the course of your debt obligation.

Let’s dig a bit further into the details.

How debt consolidation works

A debt consolidation loan effectively replaces your existing debts with a new loan, making the repayment process more convenient by bundling multiple payments into one.

Though loan terms can differ from lender to lender, debt consolidation loans often afford the opportunity to decrease your monthly payment amount, decrease the amount you’ll pay over the life of the loan, or in certain cases, both.

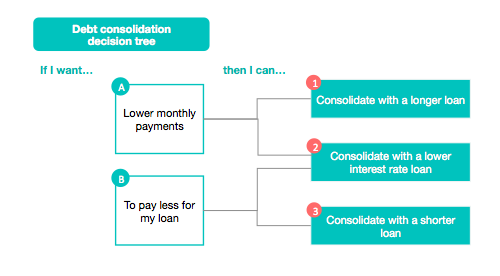

Consult the following decision tree, which outlines these options based on your specific goal:

As you’ll note from the diagram, if lower monthly payments work better for you, you can consolidate with a longer loan term. And if you’d prefer to pay less overall, you can consolidate with a shorter-term loan or one with a lower interest rate.

Debt consolidation: A hypothetical example

Let’s consider a fictional young professional, Chloe. Chloe just started a new marketing job. With a relatively high starting salary, they were surprised when after a couple of months in their new role they found themself getting nervous about when their next paycheck would hit. At their stage of life, with no dependents and few obligations, they felt that they shouldn’t be living paycheck to paycheck.

But in addition to their monthly expenses, they still have some student loans to pay off, as well as a loan to help cover living expenses from their New York City internship last summer.

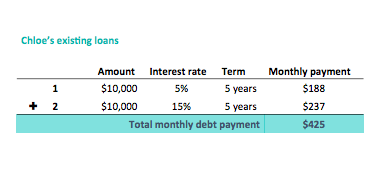

Chloe has two $10,000 loans: a student loan with a 5% interest rate and a private personal loan with a 15% interest rate. Both have to be paid off in equal monthly payments over the next five years—simply put, Chloe has to pay $425 every month ($188 for the federal loan and $237 for the private personal loan) until their debt is cleared.

Here are Chloe’s loans:

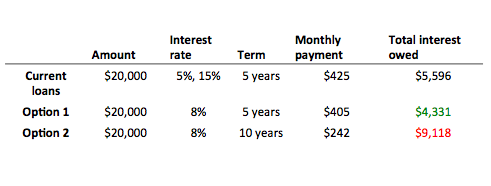

Chloe shops around and learns that they can consolidate her loans into a single loan with an 8% interest rate. They then have to make a choice around the loan term.

If they choose to pay their loan back over five years, they cut their monthly bill down to $405/month, and would save a total of $1,265 relative to their initial loan agreements.

If they choose a loan term of ten years , they’ll have a lower monthly payment ($242/month). However, they’ll pay more overall if they choose the longer-term loan. In the ten-year scenario, they have an additional five years of payments to make, and will pay an additional $4,787 in interest relative to the five-year scenario.

Chloe can now make the choice that’s right for them. Through one consolidated loan, they don’t have to keep track of different payment dates or complicated contract language and can focus on their new job.

This is all to say that debt consolidation loans replace multiple existing loans with a single loan. This can work with a variety of different loans, including unsecured debts like credit cards.

How to take advantage of debt consolidation loans

While debt consolidation loans can give you breathing room, they don’t eliminate your debt. The idea is to try to make that debt more affordable, manageable, and ultimately, cheaper.

You can manage your debt with 5 basic steps:

Step 1: Know your debt

Find the principal balance and the interest rate for each of your debts including credit cards.

Step 2: Know your goal

Determine the goal of your debt consolidation. Do you want to reduce the total sum of payments you make over the loan term, or keep a longer term and pay less every month?

Review the decision tree above to view hypothetical outcomes.

Step 3: Find your new interest rate and loan terms

There are several companies that will help you consolidate your debt, from banks to online lenders. Many companies will give you an interest rate based on your credit score, but some lenders recognize that your credit score alone does not define you.

For example, Upstart’s model looks at your education, employment and several other factors to offer you a personalized rate, even if you don’t have an extensive credit history.

Pro tip: Protect your credit score while comparing options. Some lenders may do a hard credit check during the application, which can negatively impact your credit score. You can explore loan options through Upstart, without any impact to your credit score when you check your rate.

Step 4: Choose the best option for you

As you evaluate different loans, be sure to read the fine print and check for origination fees, interest rate changes, and prepayment penalties. Once you’ve found the debt consolidation loan that works for you and your goals, it’s time to move forward.

Step 5: Pay it off

Once you receive your debt consolidation loan proceeds, it’s up to you to pay off each of your previous debts.

After that, you’ll only be liable for a single monthly payment to your new lender. Set a new payment date and enroll in automatic debit to make the process of paying as simple as possible.

You’re now on your way to financial freedom.

Won't affect your credit score¹

Won't affect your credit score¹