If you’ve already taken out a personal loan through Upstart, you know how simple and seamless the process is. The next time something unexpectedly comes up, and you need to borrow money, you might wonder whether you can take out a second personal loan, even if you’re still working on paying off your first loan.

The answer is yes—if you meet specific qualifications. We’ll walk you through how to figure out if you’re eligible to get a second personal loan through Upstart and, if you are, how the process works.

Am I eligible to get a second personal loan through Upstart?

We work with borrowers who need to take out a second personal loan, within limits. And we understand if you need to borrow more money—but to ensure you’re not overburdened, we’ve set up key criteria if you’re still paying off your first personal loan through Upstart or have already paid off your first Upstart-powered loan.

If these criteria are true, you may be eligible for a second loan.

- You only have one active personal loan through Upstart when applying

- You waited at least 6 months between loan applications

- You don’t have a disqualified application within the last 30 days

Remember that you won’t be eligible to apply for a new loan until at least six months have passed since your previous loan application.

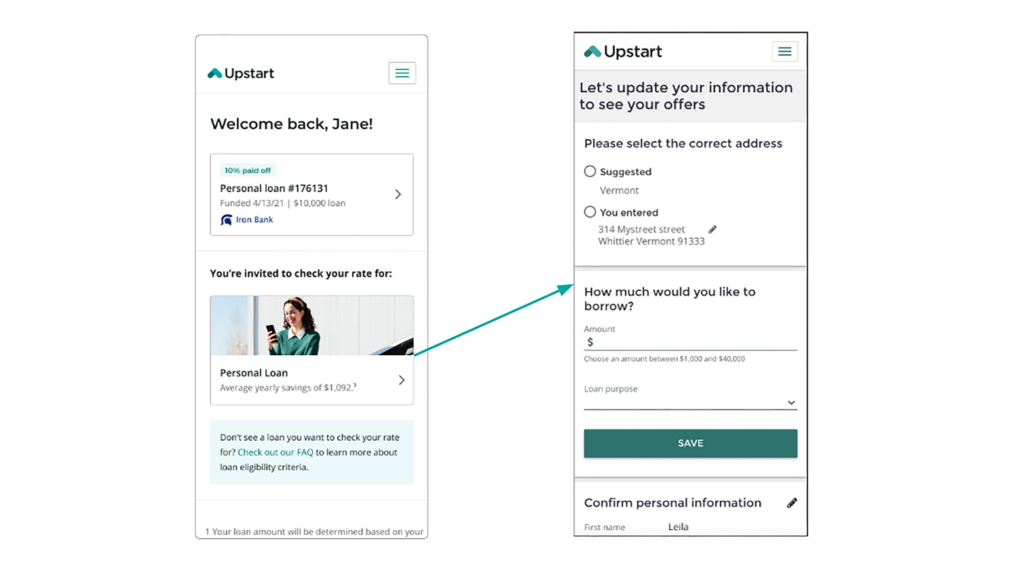

How do you take out a second loan through Upstart?

If you’ve taken out a loan through Upstart before, you’ll be happy to know that the process to apply for a second personal loan is essentially the same as before.

You may need to create a second application with a different email address. However, we’re currently working on making this process more streamlined.

The steps are as follows:

- Log into your Upstart account and go to your main dashboard

- Scroll down and click on “Check My Rate” to begin your second loan application

- Review your loan application

- Choose the offer that is best for you

- Loan decision

- Loan funded

Pros and cons of taking out a second loan through Upstart

It’s wise to consider the benefits and drawbacks of any big financial move before you do it, including taking out a second loan. Here are some things to consider:

Pros

- You can open new possibilities: Taking out a second personal loan can help you unlock new possibilities, such as moving to a new part of the country, getting the medical care you need, or consolidating high-interest credit card debt to make it easier and simple to pay off.

- You may be able to get a better rate: If you didn’t miss any payments on your previous loan on Upstart, your credit score might have gone up since you last applied. That means you may be able to get a better rate, too.

- You’re already familiar with how Upstart works: Since you’ve already taken out a loan through Upstart before, you’re already familiar with how things work. You’ll know what documents you need, what to expect, and how to manage your loan because you’ve done it before.

Cons

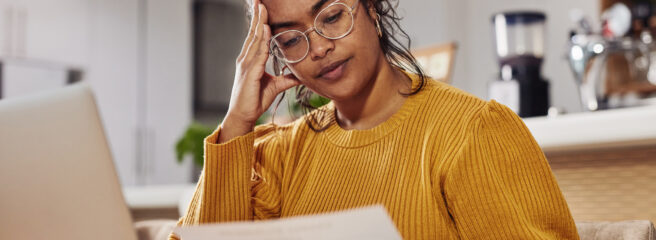

- You may impact your credit: Taking on more debt can affect your credit score. Taking on two loans at once can raise your risk of making a late payment, potentially hurting your credit.

- You can get caught in a debt cycle: Personal loans are good when used wisely, but not if you rely on them exclusively. Remember to save up for emergencies and other financial goals, too.

Check your rate on a second loan

If you need to borrow money, consider checking your rate on a new loan through Upstart. You might find that you may qualify for an even better rate this time, and that can make paying off your new loan even easier than before.

All loans are originated by lending partners on the Upstart marketplace.

Won't affect your credit score¹

Won't affect your credit score¹