Upstart Macro Index (UMI)

May UMI

Historical UMI

Subscribe for first access to monthly UMI updates

I accept Upstart's terms and privacy policy .

I accept Upstart's terms and privacy policy .

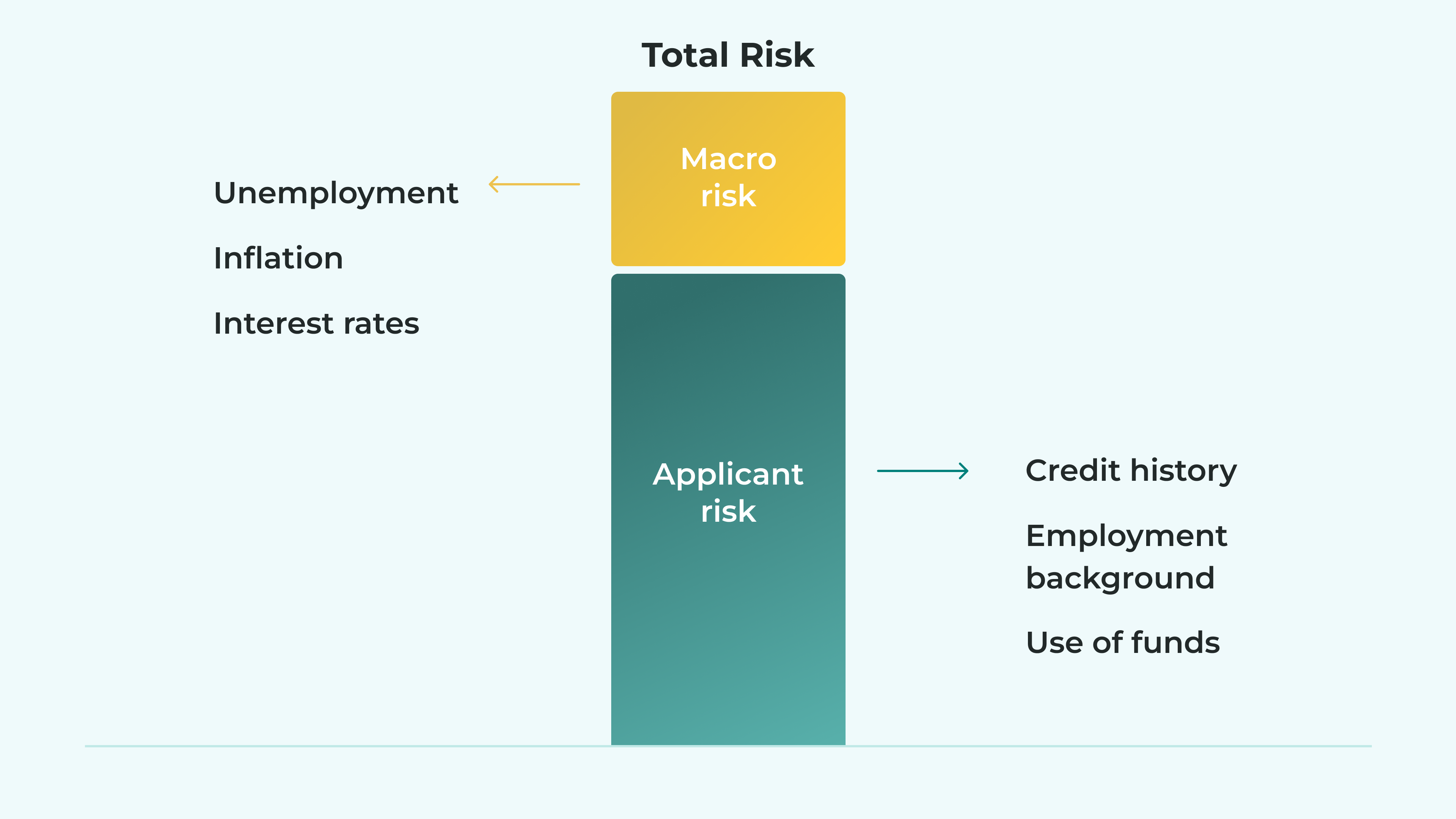

To better understand the Upstart Macro Index, it’s helpful to start with how lenders measure the risk that a borrower won’t pay back their loan.

The likelihood that a loan will default is a combination of the risk represented by the applicant themselves combined with the impact of the macroeconomic environment, including factors such as unemployment and inflation.

However, traditional risk models are not able to distinguish between these two sub-categories of risk. This makes it difficult for lenders to understand how the macroeconomic environment is impacting their portfolio performance. This, in turn, makes it unclear how lenders should adjust their lending programs in response to evolving conditions.

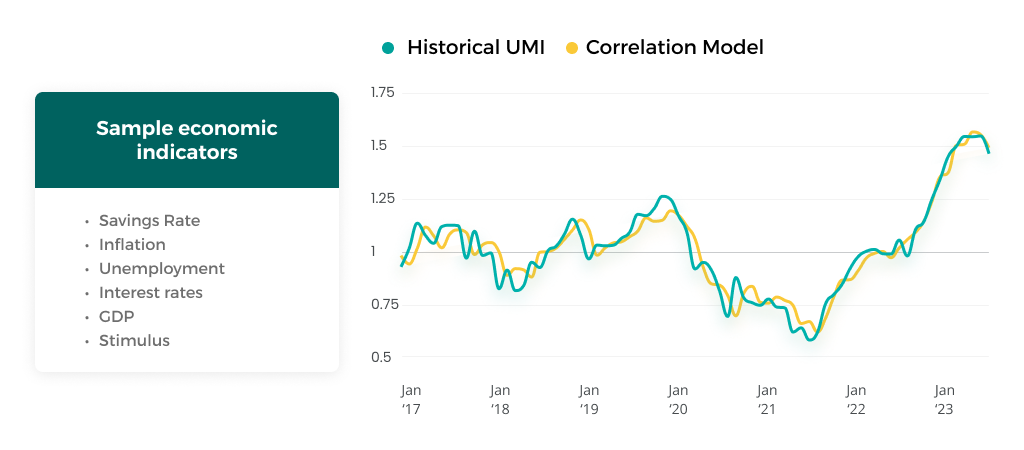

To help address this challenge, we’ve developed the Upstart Macro Index, which is designed to isolate and estimate the impact the changing economy has on defaults within Upstart-powered loan portfolios. A UMI of 1.0 means current defaults are equal to the long-term expected average default rate in the market. A UMI of 1.25 implies defaults are 25% higher than the long-run expected average while a UMI of 0.75 would mean defaults that are 25% lower than the long-run expected average.

Because Upstart’s risk models are regularly recalibrated to changing macroeconomic conditions, a UMI above 1.0 does not imply that loans are underperforming—and a UMI below 1.0 does not imply that loans are overperforming. Instead, Upstart’s risk models are regularly adjusted to conservatively account for the most recent trend in UMI.

This calibration adjusts the loss assumptions and thereby the interest rates and approval rates for new loan originations on our marketplace.

While we are not yet able to accurately forecast future macroeconomic conditions, UMI is designed to provide near real-time insight into how today’s macroeconomic environment impacts Upstart-powered loan portfolios. We’re investing in UMI to help our bank and credit union partners make more informed decisions about their lending programs. To learn more about how Upstart can help your bank or credit union, visit upstart.com/lenders.

UMI is enabled by Upstart’s unique risk models that estimate likelihoods of default and prepayment for each month of every Upstart-powered loan. We refer to this as our patented loan-month model. This unique risk model allows us to more accurately separate applicant risk from macro risk—and to measure the macro risk more rapidly.

Traditional lending models quantify the risk of a portfolio of loans based on criteria such as average credit score, income, and debt ratio. These estimates are commonly done at the portfolio level, rather than at the loan level. This approach can produce a useful, but imprecise, prediction of the loss rate for a portfolio.

More modern risk models quantify the unique risks of default and prepayment for each loan in the portfolio.

Upstart’s models predict the risk of both default and prepayment individually for each month of each loan, providing a more precise measure of expected losses, and unlocking a faster, more accurate way to measure the impact of macroeconomic conditions on a borrower’s ability to repay their loans.

We continue to explore how economic conditions impact credit performance. One active area of research is how commonly forecasted macroeconomic factors can predict UMI. We have built some early models that show promise—and we will continue to invest in this area to help our lenders and investors better understand the factors driving loan performance.

Upstart intends to release UMI monthly, including revisions to prior months when applicable, so subscribe here if you want to keep up with the newest developments.

LEGAL DISCLAIMER

The statements and information on this site are current as of March 22, 2023, unless another date with respect to any information is indicated, and are provided for informational purposes only. Past UMI performance can provide no assurance and is not indicative of future UMI results. UMI is based on historical data and Upstart’s analysis of the losses within Upstart-powered loan portfolios and is specific to Upstart’s borrower base. UMI is not intended to measure the macroeconomic risks in terms of losses of loan portfolios or asset classes that are not Upstart-powered loans, including loans held by other segments of the U.S. population. It is not designed to measure the current state of the overall economy or to measure or predict future macroeconomic conditions, trends or risks. It is also not designed to measure or predict the future performance of Upstart-powered loans or of Upstart’s other products, overall financial results of operations or stock price. We expect that our research and development efforts to improve UMI could result in changes or revisions to current or past UMI values.

All forward-looking statements or information on this site are subject to risks and uncertainties that may cause actual results to differ materially from those that Upstart expected. Any forward-looking statements or information on this site are only as of the date hereof. Upstart undertakes no obligation to update or revise any forward-looking statements or information on this site as a result of new information, future events or otherwise. More information about these risks and uncertainties is provided in Upstart’s public filings with the Securities and Exchange Commission, copies of which may be obtained by visiting Upstart’s investor relations website at www.upstart.com or the SEC’s website at www.sec.gov.

For the Upstart Macro Index Terms of Use, go here.