Simplify your bills with a debt consolidation loan

Check your rate in 5 minutes.

Get funds sent in as fast as 1 business day.²

Consolidate your bills into 1 fixed monthly payment.

Won't affect

your credit score¹Why choose Upstart for a debt consolidation loan?

We think you’re more than your credit score. Our model looks at other factors, like education³ and employment, to find you a rate you deserve.

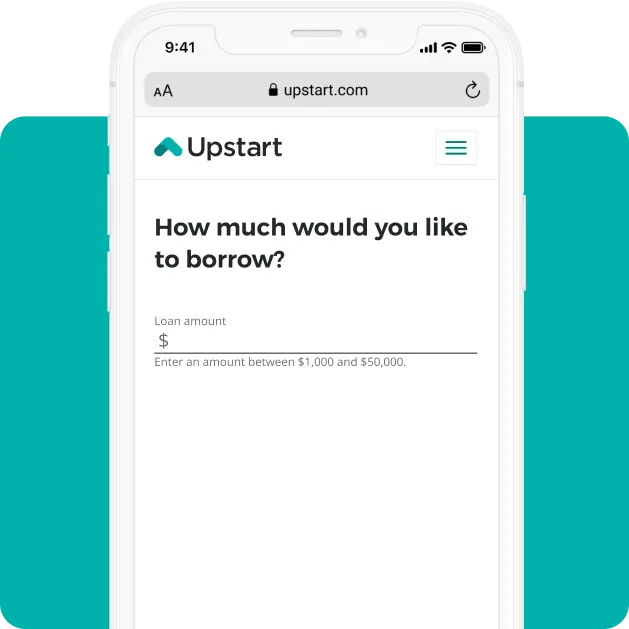

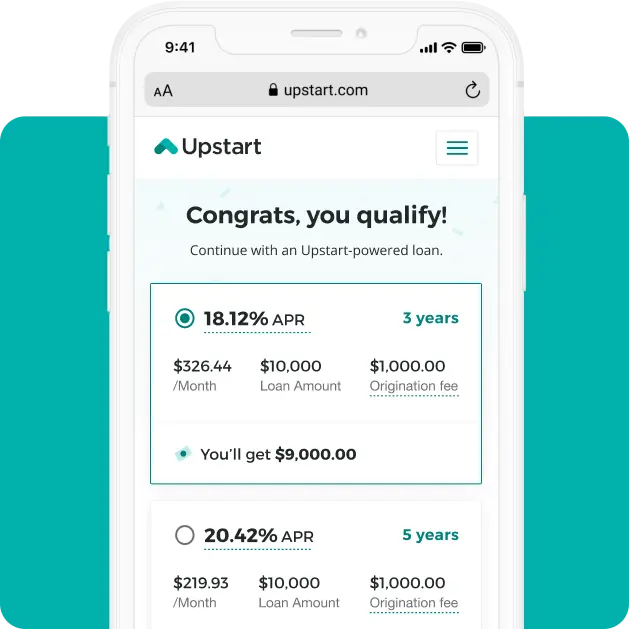

Flexible loan amounts

You can apply for a debt consolidation loan ranging from $1,000 and $50,000.⁴

Fixed rates and terms

Choose between debt consolidation loans with 3 or 5 year terms, with fixed rates of 6.6% - 35.99% APR.⁵

No prepayment fees

You can prepay your debt consolidation loan at any time with no fee or penalty.

We've helped more than 3 million customers⁶

Akilah took control of her debt in May 2022⁷

"Upstart is easy to use, reasonable, and fast. It has never been so easy to consolidate my debt."

How to get a debt consolidation loan online

Get your rate

It takes less than 5 minutes to check your rate—and it won’t affect your credit score.¹

Get approved

Most borrowers are instantly approved with no paperwork required.⁸

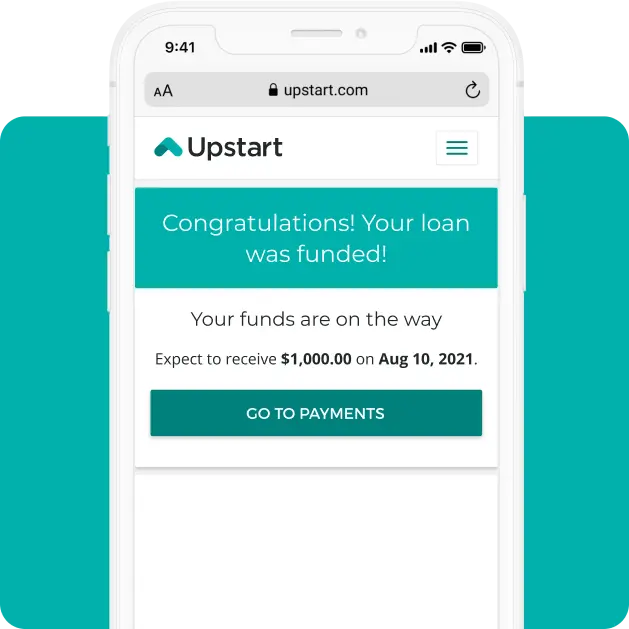

Get funds

Once approved, you could get funds sent in 24 hours or less.²

Won't affect

your credit score¹Debt consolidation loan FAQs

What is a debt consolidation loan?

A debt consolidation loan is a type of personal loan that you can use to combine several high-interest debts into a single loan with a fixed monthly payment.Which types of debt can I consolidate?

Debt consolidation loans are useful for managing revolving lines of credit and high-cost loans that have high interest fees. Some of these debt types include credit cards, retail credit cards, gas cards, payday loans, and title loans.What are the advantages of loans for consolidating debt?

With a debt consolidation loan, you can take back control of your financial future.

- Convenient single monthly payment: Once you combine several of your debt payments into one, you can free yourself from revolving debt and the need to keep track of multiple payments.

- Savings possibilities: With the right loan terms, you can pay off your debt faster and save money on interest if you qualify for a lower interest rate.

- Predictable payment amount: Many debt consolidation loans come with a fixed interest rate, which means that the interest rate will stay the same over the life of your loan. Since you’ll know how much you owe each month, you can determine when your debt will be paid off.What are the risks of debt consolidation?

Consolidating debt may be a tool you can use to help pay off your debt, but it may not be the right tool for everyone. Before you decide, it’s essential to consider all the potential risks of getting a debt consolidation loan. Keep in mind that the risks will vary from lender to lender.

- Fees. Lenders may charge closing fees, loan origination fees, and balance transfer fees, which can add up.

- Collateral. Some lenders may require you to put down collateral you own, like a car or home, to back up the loan. If you default on the loan, the lender may take the collateral to compensate for your missed payments.

- No guarantee of a lower interest rate. Consolidating a loan doesn’t automatically mean you’ll qualify for a lower interest rate. The rate you get will depend on the state of the market and details you provide to your lender.How do I qualify for a consolidation loan?

To qualify for a debt consolidation loan, you’ll need to provide some personal and financial information about yourself, which varies by lender. Typically, lenders will check your credit score, income, credit history, and debt to qualify you for a debt consolidation loan.

At Upstart, we know that you’re more than your credit score. That’s why our model considers other factors including your education³, employment, and credit history when you apply.Does debt consolidation affect my credit score?

When you check your rate, we’ll do a preliminary soft credit inquiry. This will have no impact on your credit score. If you accept your rate and decide to complete an application for a debt consolidation loan, we’ll do a hard credit inquiry.

The hard credit inquiry will impact your credit score, but it should not be cause for alarm. This is a normal part of the process. As long as you make your monthly loan payments on time, your credit score will bounce back and may even improve.How much debt do I need to consolidate?

The amount of debt you consolidate is entirely up to you. However, it’ll likely make more financial sense for you to consolidate if you have a large amount of debt. Why? New loans, like a consolidation loan, could come with fees and a credit check. If you have a small amount of debt that can be paid off in a year, it might not be worth the hassle.After I'm approved, how long does it take to get the money?

Customers who have accepted a debt consolidation loan through Upstart have received funding as soon as 1 business day.²

Explore a debt consolidation loan today

Won't affect

your credit score¹Other loan options

1. When you check your rate, we check your credit report. This initial (soft) inquiry will not affect your credit score. If you accept your rate and proceed with your application, we do another (hard) credit inquiry that will impact your credit score. If you take out a loan, repayment information may be reported to the credit bureaus.

2. If you accept your loan by 5pm EST (not including weekends or holidays), your funds will be sent on the next business day. When the funds will be available to you will depend on your bank’s transaction processing time and policies.

3. Neither Upstart nor its bank partners have a minimum educational attainment requirement in order to be eligible for a loan.

4. Applicants can now apply for loan amounts over $50,000. Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will qualify for the full amount. Minimum loan amounts vary by state: GA ($3,100), HI ($2,100), MA ($7,000).

5. The full range of available rates varies by state. A representative example of payment terms for an unsecured Personal Loan is as follows: a borrower receives a loan of $10,000 for a term of 60 months, with an interest rate of 19.60% and a 6.90% origination fee of $690, for an APR of 23.22%. In this example, the borrower will receive $9,310 and will make 60 monthly payments of $264. APR is calculated based on 5-year rates offered in March 2025. There is no downpayment and no prepayment penalty. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved.

6. As of 3/31/2025, across the entire Upstart marketplace.

7. Images are not actual customers, but their stories are real.

8. The majority of unsecured loan borrowers on the Upstart marketplace are able to receive an instant decision upon submitting a completed application, without providing additional supporting documents, however final approval is conditioned upon passing the hard credit inquiry. Loan processing may be subject to longer wait times if additional documentation is required for review.

Upstart is not the lender. All loans on Upstart's marketplace are made by regulated financial institutions.