By Dave Girouard, CEO & co-founder, Upstart

August 8, 2022

Today we released our earnings results for Q2 2022. While we reported 18% growth in revenue year-on-year, we also guided toward a 25% reduction in revenue from the second quarter to the third, reflecting funding constraints in our marketplace. A decline in revenue is obviously disappointing, and it’s natural to ask whether our AI-based credit model continues to work as designed. We’re confident it does, so we want to explain what’s happening and how we’re addressing it.

Credit performance

When lenders underwrite loans, their goal is to approve the good loans and decline the bad ones. However, this isn’t a simple yes or no decision; approved loans need to be priced relative to their likelihood of successful repayment (known as risk-based pricing). So an important way to assess the accuracy and value of a credit model is to look at how well it identifies and separates high and low risk borrowers.

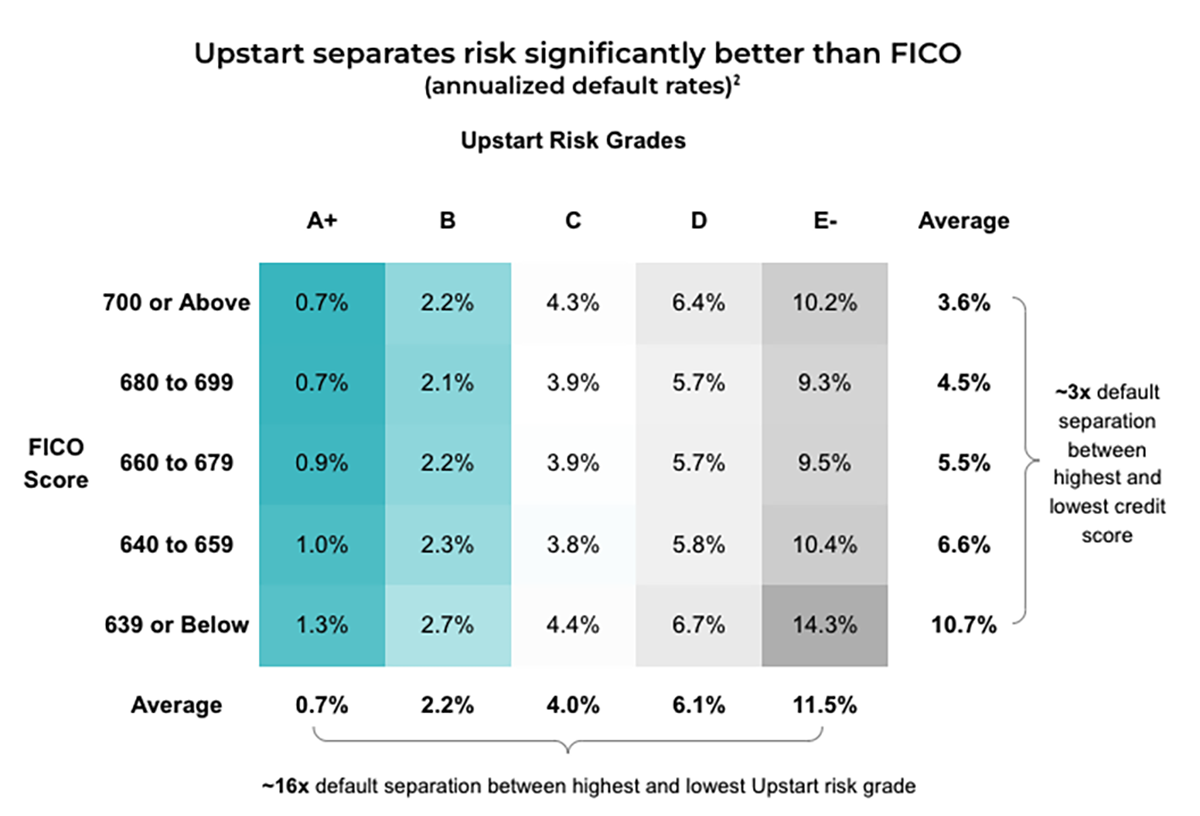

How does Upstart’s AI model separate risk relative to a standard credit score? The table in Figure 1 contains the actual annualized default rates for the last four years of Upstart-powered loans—segmented into rows by credit score and segmented into columns by the Upstart risk grade. These are actual default rates for almost two million loans.¹

Figure 1

Our credit model continues to assess risk better than traditional credit score.

If you look across any row, you can see how Upstart’s risk grades predict a steadily increasing default rate from left to right as the borrowers get riskier, as it should. But if you look at any column from top to bottom, there’s relatively little difference between default rates, regardless of FICO score. In fact, across these almost two million loans in our marketplace, Upstart’s AI model provides five times more precision than FICO in terms of separating low-risk borrowers from high-risk ones. We are confident that our model has never been more accurate.

By way of background, loans on Upstart are commonly funded in two different ways: for lower-risk borrowers, our bank and credit union partners typically originate loans according to their own credit policy, and hold those loans on their balance sheet. For higher-risk borrowers, the loans are commonly originated by bank partners and then sold later to institutional investors.

So how have Upstart-powered loans performed? For our bank and credit union partners, the answer is extremely well. From 2018 through to the end of 2021, all quarterly loan vintages retained by our bank partners are currently forecasted to meet or exceed the target returns set at the time of origination.

And what about our institutional buyers? Over the same period, they have seen 12 quarterly vintages expected to overperform, with five expected to underperform.

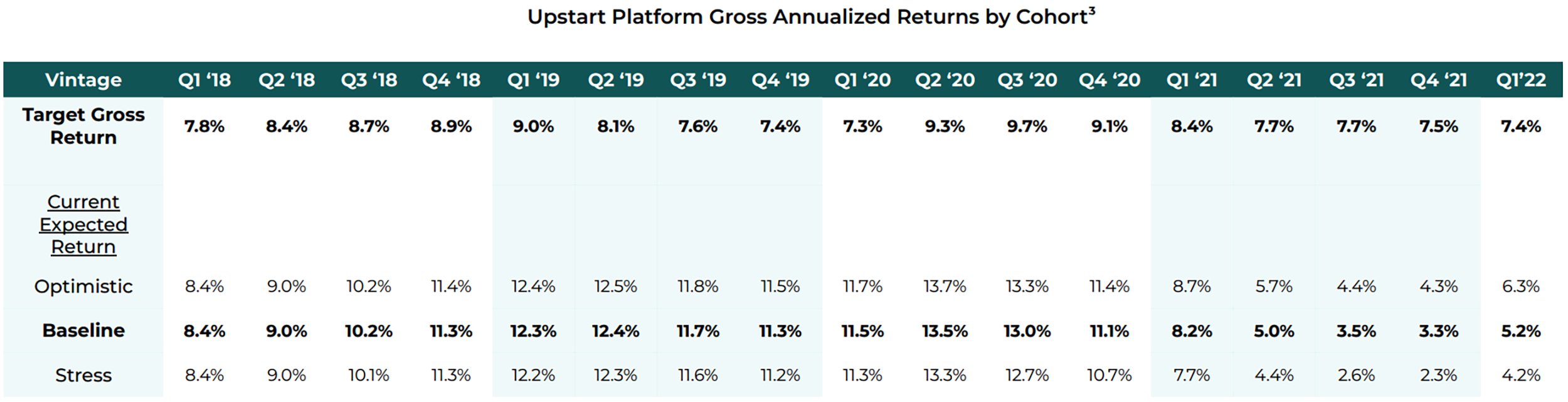

The table below (Figure 2) shows expected returns for each quarterly vintage across the entire Upstart marketplace (including all risk grades).

Figure 2

Our credit performance remains solid. If an investor invested equally in all Upstart cohorts, they would now expect a 9.8% gross annualized return.⁴

Lending has always been a cyclical industry, so it’s important to take a long-term view. If a loan buyer invested equally in all cohorts since Q1 2018, they would now expect a positive return on all vintages thus far, with an overall 9.8% gross annualized return, compared to a target of approximately 8% (Figure 2). This compares to a return of less than 3% in the US High Yield Bond Index over that same period.⁵ Even our underperforming vintages are expected to outperform the US High Yield Bond Index. You can read more about our credit performance in the FAQ deck on our IR page.

The macro impact

While separating good loans from bad is critical to underwriting, it’s not the only factor that determines aggregate returns. The overall health of the economy can shift the default rates of all loans up or down. In 2020, the introduction of unprecedented stimulus led to a large decline in default rates for most types of loans, while the end of stimulus in late 2021 led to a large and expected increase in default rates, again for most types of loans.

Forecasting macro is inherently difficult, and it’s not realistic for our risk model to reliably predict major economic events or policy changes. Instead, our model aims to be the fastest to react to changes in macroeconomic conditions, to adopt a consensus-driven view of future assumptions, and to deliver target returns on average across a full credit cycle.

Today, we believe our model is well calibrated to the current economic cycle and is making conservative assumptions about the future. Specifically, our model is calibrated to a continued slowing of the economy over the next two years, consistent with high inflation, recessionary conditions, and an increase in unemployment.

Moving toward committed capital

Given the strength of our model, our strong credit performance, and our conservative calibration to the current economic environment, why have some of our lenders and institutional investors paused or reduced their originations? (To be clear, these lenders and investors have not canceled their agreements with Upstart; but rather have paused or reduced their monthly loan volumes.)

In short, we’ve seen a greater increase in loss aversion over the past quarter than we expected. Given the unusual uncertainty in the market, our partners are understandably far more worried about potential losses than motivated by potential gains. As a result, some of them have paused or reduced their originations in unsecured lending, which has limited our ability to grow.

However, when there’s less competition among lenders and investors on our platform, as there is right now, we believe there’s a unique opportunity to take conservative positions and yet generate increased profits by adjusting credit and return parameters appropriately. Despite this, we’ve still seen a decline in participation by both lenders and investors.

As a result, we came to the conclusion that we need to move toward bringing committed capital onto our platform, with long-term partnerships with those who recognize the value of Upstart’s unique ability to originate quality credit. While we expect to continue to provide a place for “at-will” credit investors, we aim to bring a significant fraction of our flow under long-term committed agreements.

This won’t happen overnight—these agreements are complex and it’s critical that we work with the right partners. During this transitional phase, we may choose at times to leverage our own balance sheet to bridge to this newer model.

Why do this? We understand better than anybody how our model is performing today. We believe that it’s well calibrated for the current economic environment and that the opportunity to generate outsized profits on our platform is significant right now. So we’re comfortable putting our balance sheet to work as necessary to navigate this transition.

We acknowledge that this is a significant shift relative to what we planned and communicated earlier this year. Yet, if my co-founders and I have learned anything after working together for more than 10 years, it’s that a volatile environment requires thoughtful and nimble execution. We believe betting on our own marketplace will provide stability for the business as we move toward long-term committed capital, demonstrate confidence in our model, and take advantage of some of the economic opportunities we see available on our platform until lenders increase their originations again.

A durable business

In the meantime, we believe we have the financial flexibility to survive and thrive through a variety of market conditions and to achieve our ambitious long-term goals. Our fixed costs are low, our gross margins are high, and we have nearly $800 million of unrestricted cash on our balance sheet, even after repurchasing over three million shares of Upstart stock for approximately $125M in the second quarter. As you can see from our guidance, even with revenues off significantly from our prior peak, we’re still roughly a break-even business and expect to continue to generate positive cash flow.

Our mission is to leverage modern data science and technology to improve access to affordable credit. This means we’re on a different journey than peers focused on wealthy and traditionally prime consumers. We’re confident that our AI-based risk model is more accurate than ever, and that we can help millions of Americans gain access to affordable credit through our nation’s banking system while also generating strong returns for investors through good times and bad.

Dave Girouard

CEO & co-founder

—

¹ Upstart internal performance data as of July 29, 2022. Consists of all originations made 2018-Q1 to 2021-Q4 “vintages.”

² Upstart internal performance data as of July 29, 2022. Consists of all originations made 2018-Q1 to 2021-Q4 “vintages.”

³ Upstart internal performance data as of July 29, 2022. “Optimistic”, “baseline” and “stress” percentages are based on Upstart’s own internal estimates of the returns observed on each vintage to date.

⁴ Gross annualized return per Upstart internal calculation including assumption of future cash flows based on most recent performance data.

Forward-Looking Statements

This post contains forward-looking statements, including but not limited to, statements regarding the performance of our AI model and our future plans. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”, “target”, “aim”, “believe”, “potential”, “may”, “will”, “should”, “becoming”, “look forward”, “could”, “would”, “can have”, “continue”, “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Forward-looking statements give our current expectations and projections relating to our financial condition; macroeconomic factors; plans; objectives; growth opportunities; assumptions; risks; future performance; business; and any investments. Neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. The forward-looking statements included in this post and on the related credit performance are made as of the date hereof. Upstart undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. More information about factors that could affect our results of operations and risks and uncertainties are provided in our public filings with the Securities and Exchange Commission, copies of which may be obtained by visiting our investor relations website at www.upstart.com or the SEC’s website at www.sec.gov. These risks and uncertainties include, but are not limited to, our ability to sustain our growth rates; to manage the adverse effects of macroeconomic conditions and disruptions in the credit markets; our ability to maintain diverse and robust loan funding programs; the effectiveness of our credit decisioning models and risk management efforts; our ability to retain existing, and attract new, bank partners and lenders; and our ability to operate successfully in a highly-regulated industry.