Home Improvement Loans

Check your rate in 5 minutes.

Get funds sent in as fast as 1 business day.²

33% lower rates than a traditional model.³

Won't affect

your credit score¹Why choose Upstart for your home improvement loan?

Our online process makes it easy to apply for a home renovation loan. Fix a leaky roof, remodel your kitchen, or update your backyard—we're here to help make your home a dream home.

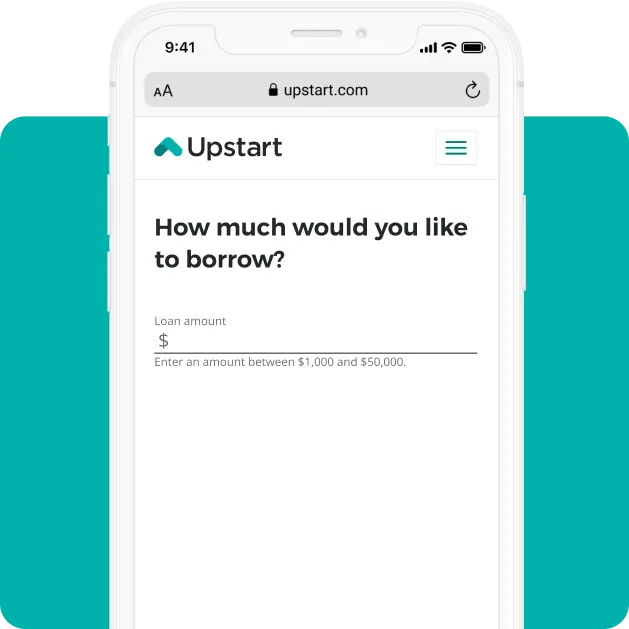

Flexible loan amounts

Choose an amount for a home improvement loan between $1,000 and $75,000.⁴

Term period options

Your home, your term. Decide between a 3 or 5 year term⁵ for your home improvement loan.

No collateral required

Get funds without putting collateral down with an unsecured⁶ home improvement loan.

We've helped more than 4 million customers⁷

SMG used a Home Improvement loan to create the home of his dreams⁸

"The process is fast and seamless. I didn't miss a beat completing my home renovation loan. I would definitely use this company again"

Apply for a home improvement loan online in 3 steps

Get your rate

It takes less than 5 minutes to check your rate—and it won’t affect your credit score.¹

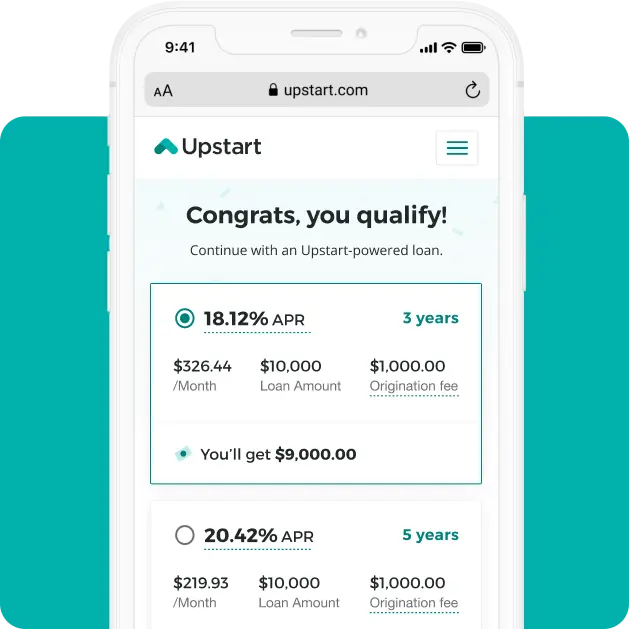

Get approved

Find out if you're approved, instantly with no paperwork required.¹⁰

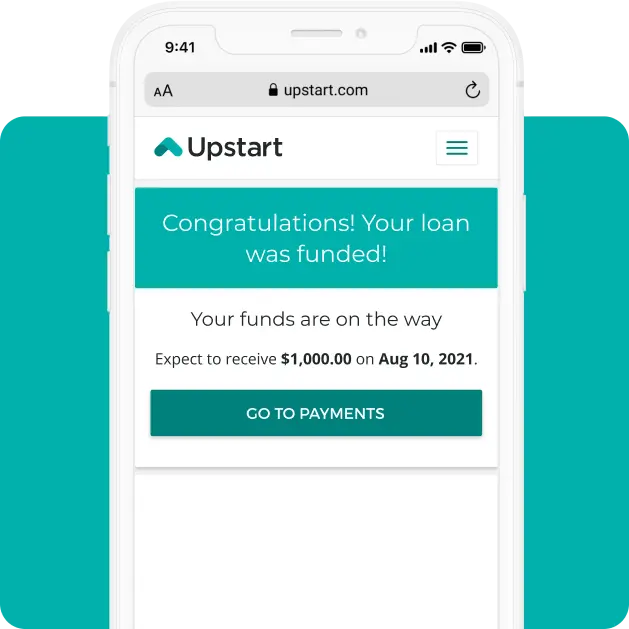

Get funds

Once approved, you could get funds sent in 24 hours or less.²

Won't affect

your credit score¹Home renovation loan FAQs

What is a home improvement loan?

A home improvement loan is a type of personal loan you can use to get funds for home repairs and projects. Many lenders typically offer unsecured loans for home improvement, which means you don't need to back up your loan with collateral. There may be an option to secure your personal loan through Upstart with your vehicle, which will require a lien to be placed on the vehicle.What can I use a home improvement loan for?

A home improvement loan can be used for expenses related to many different types of home repairs or projects. If you pay off your home improvement project and you have some of your loan funds leftover, you can use the funds for other bills or you can add it onto your loan's next monthly payment to pay it off faster.

You can use a home improvement loan to remodel a kitchen, add a bathroom, expand a room, repair a deck, replace a roof, install solar panels or whatever else you dream up!How do home improvement loans work?

If you're unsure about how the home improvement loan process works, check it out below:

1. Check your options and get your rate. We'll ask you some questions you can answer in a matter of minutes. Details we'll need include the loan amount, loan purpose, your full name, date of birth, address, and email.

2. After you submit the information above, we'll find you options you qualify for. Then, you can select the amount, term, and rate that fit your financial needs.

3. Next, we'll ask you to submit a loan application with more information about you and your bank account so we can validate it. Unlike some lenders, we consider more than your credit score to determine whether you'll qualify for a home remodel loan. Additional factors we consider include your education⁹ and employment.

4. After you've accepted the final terms of the loan agreement, we'll start working on approving and funding your loan. You could get funds sent in as fast as 1 business day.²How much can I borrow with a home repair loan?

Upstart offers low-interest, fixed-rate home improvement loans between $1,000 - $75,000⁴ for home renovation projects to customers.Can I get a home improvement loan with no equity?

Home equity is the amount of your home that you own. If you don't have home equity, but you need funds for a home remodel project, apply for an unsecured⁶ personal loan for home improvements. Upstart's platform offers unsecured home improvement loans that give you the power to tackle all of your home improvement needs, regardless of your equity.Is a home improvement loan the right option for me?

It’s a great choice if you need some money to help you fund a home repair or project. If you'd like to consider other options like a Home Equity Line of Credit (HELOC), learn more with our guide here.What are the benefits of a home improvement loan through Upstart?

- Quick and simple online application

- Fixed interest rates

- Predictable monthly payments

- Direct deposit for funds

Check your home improvement loan rate in as little as 5 minutes

Won't affect

your credit score¹More personalized loan options

1. When you check your rate, we check your credit report. This initial (soft) inquiry will not affect your credit score. If you accept your rate and proceed with your application, we do another (hard) credit inquiry that will impact your credit score. If you take out a loan, repayment information may be reported to the credit bureaus.

2. If you accept your loan by 5pm EST (not including weekends or holidays), your funds will be sent on the next business day. When the funds will be available to you will depend on your bank’s transaction processing time and policies.

3. As of publication in April 2025, and based on a comparison between the Upstart model and a hypothetical traditional model using Upstart data from Jan - Dec 2024. For more information on the methodology behind this study, please see Upstart’s Annual Access to Credit results here.

4. Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will qualify for the full amount. Minimum loan amounts vary by state: GA ($3,100), HI ($1,500), MA ($7,000). Maximum loan amounts may vary by state.

5. The full range of available rates varies by state. The lowest rates are only available to the most qualified applicants. A representative example of payment terms for an unsecured Personal Loan is as follows: a borrower receives a loan of $10,000 for a term of 60 months, with an interest rate of 18.60% and a 7.82% origination fee of $782, for an APR of 22.69%. In this example, the borrower will receive $9,218 and will make 60 monthly payments of $259. APR is calculated based on 5-year rates offered in December 2025. There is no downpayment and no prepayment penalty. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved.

6. While most loans through Upstart are unsecured, certain lenders may place a lien on other accounts you hold with the same institution. There may be an option to secure your personal loan through Upstart with your vehicle, which will require a lien to be placed on the vehicle. It is important to review your promissory note for these details before accepting your loan.

7. As of 12/31/2025, across the entire Upstart marketplace.

8. Images are not actual customers, but their stories are real.

9. Neither Upstart nor its bank partners have a minimum educational attainment requirement in order to be eligible for a loan.

10. The majority of unsecured loan applicants on the Upstart marketplace are able to receive an instant decision upon submitting a completed application, without providing additional supporting documents, however final approval is conditioned upon passing the hard credit inquiry. Loan processing may be subject to longer wait times if additional documentation is required for review.

Upstart is not the lender. All loans on Upstart's marketplace are made by regulated financial institutions.